Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

Best Banks for EV Loans in India (2025 Guide)

The introduction: Rise of electric vehicles and cheep financing.

India’s electric vehicle (EV) revolution is gathering pace. Whether it is compact city hatchback or two-wheelers and even commercial vehicles, electric mobility is not a future—it is here and now. In 2024, the government incentives, the infrastructure of rapid charging, and the increase in environmental awareness promoted sales of EV in India to exceed the mark of one million vehicles in the first time.

However, despite the subsidies, the initial cost of EV is still higher than that of their petrol or diesel equivalents. Cheap financing is vital to most potential customers, both individual and corporate. This is where banks can come in by providing special EV loan products to render green vehicles more affordable.

In this exhaustive primer we dissect the most promising EV finance banks as at 2025 in India. We compare their services, preferable conditions, prices, advantages and procedures. There you will also read the expert advice and useful recommendations that will help you to find the right finance of your green ride.

What is So Important about Specialized EV Loans?

Vehicle financing: The Uniqueness of EV financing

Electric vehicles differ from conventional ICE (internal combustion engine) vehicles in several ways:

- Increased initial price: Most EVs cost more as compared to their petrol/diesel cousin even after subsidy.

- Technological risk: Lithium deterioration of battery and advancing technology has the potential of loss in re-sale value.

- Government incentives: Central as well as state governments provide subsidies and these may be correlated to the release of loans.

- Insurance and maintenance: The lower value than that of ICE vehicles.

In the light of these elements, even banks have launched customized EV loan products that include:

- Interest rates that are less than the ordinary auto loans

- Repayment tenures that are longer

- Greater ratios of loan to value

- Fast green purchasing

Leading Banks Offering the Best EV Loans in India (2025)

1. State Bank of India (SBI) – SBI Green Car Loan

| Feature | Details |

|---|---|

| Interest Rate | Starting at 8.75% p.a. |

| Tenure | Up to 8 years |

| Loan-to-Value | Up to 90% of on-road price |

| Processing Fee | Nil (for select models) |

Benefits:

- Low-interest rate compared to ordinary car finance

- Zero processing fee on some models

- Accommodative repayment terms

- Available in urban and rural branches

Expert Insight:

SBI’s wide branch network suits both metro and non-metro customers.

2. HDFC Bank – GreenCar Loan

| Feature | Details |

|---|---|

| Interest Rate | Starts at 9% p.a. |

| Tenure | Up to 7 years |

| LTV | Up to 100% of ex-showroom price |

| Processing Fee | Rs. 3,000–Rs. 5,000 |

| Prepayment | Nil after 24 EMIs |

Benefits:

- Fast digital application process

- 100% financing on select models

- Tie-ups with top EV manufacturers

Expert Insight:

A tech-friendly option ideal for urban professionals.

3. Axis Bank – Car Loan or eMobility Vehicle Loan

| Feature | Details |

|---|---|

| Interest Rate | Minimum 9.25% p.a. |

| Tenure | Up to 7 years |

| LTV | 90% |

| Processing Fee | As per norms |

Benefits:

- Flexible EMI options (step-up/step-down)

- Doorstep documentation collection

- Dedicated green loans support

4. ICICI Bank – Electric Car Loan

| Feature | Details |

|---|---|

| Interest Rate | Minimum 9% p.a. |

| Tenure | Up to 7 years |

| LTV | 100% |

| Processing Fee | Starts from Rs. 3,499 |

Benefits:

- Quick digital approvals

- Special EV offers with partner brands

- Pre-approved customer benefits

5. Punjab National Bank (PNB) – PNB Green Vehicle Loan

| Feature | Details |

|---|---|

| Interest Rate | RLLR + 0.25% (approx 8–9%) |

| Tenure | Up to 7 years |

| LTV | 85% |

Benefits:

- Lower margin than standard car loans

- Open to individuals and businesses

- Focus on promoting commercial EVs

Other Prominent Lenders for EV Financing

- Tata Capital – Retail loans up to 5 years, instant sanctions for Tata Motors EVs

- Hero FinCorp – Quick approvals for electric two-wheelers at dealerships

- Canara Bank, Bank of Baroda, Yes Bank – Offer competitive rates in public and private segments

Eligibility Criteria: Who Can Apply?

Applicant Type

- Salaried or self-employed individuals

- Companies, firms, fleet operators

Age

- Minimum: 21 years

- Maximum at loan closure: 65 years

Income

- Minimum monthly income: ₹15,000 to ₹25,000

Credit Score

- Preferred score: 700+

Documents Required

- KYC (Aadhaar, PAN, Voter ID)

- Income proof (salary slip/ITR/bank statement)

- Proforma invoice

- Employment/business proof

EV Loan Process: Step-by-Step Guide

Research Your EV

- Choose model, check price, get dealer invoice

Compare Loan Offers

- Use online calculators or visit bank branches

Apply

- Fill application online or offline

Document & Credit Check

- Submit required documents, undergo credit verification

Loan Sanction

- Receive offer letter with terms

Sign & Disbursement

- Sign agreement, amount transferred directly to dealer

Vehicle Delivery

- Register vehicle and take delivery

Repayment Begins

- EMIs start as per agreed schedule

Benefits of Taking EV Loan from Bank

- Reduces Upfront Costs

- Lower Interest on Green Loans

- Flexible EMI Plans

- Bundled Offers & Insurance

- Credit Score Building

- Support for Sustainable Goals

Expert Tips Before Applying

- Calculate Total Ownership Cost: Factor in savings on fuel/maintenance but consider battery/resale.

- Know What the Loan Covers: Some loans exclude RTO/insurance.

- State Subsidies Matter: They affect how much loan you need.

- Prepayment & Processing Charges: Confirm charges upfront.

- Compare Insurance Offers: Sometimes standalone policies are better.

- Use Online or Visit Branch: Choose based on your comfort.

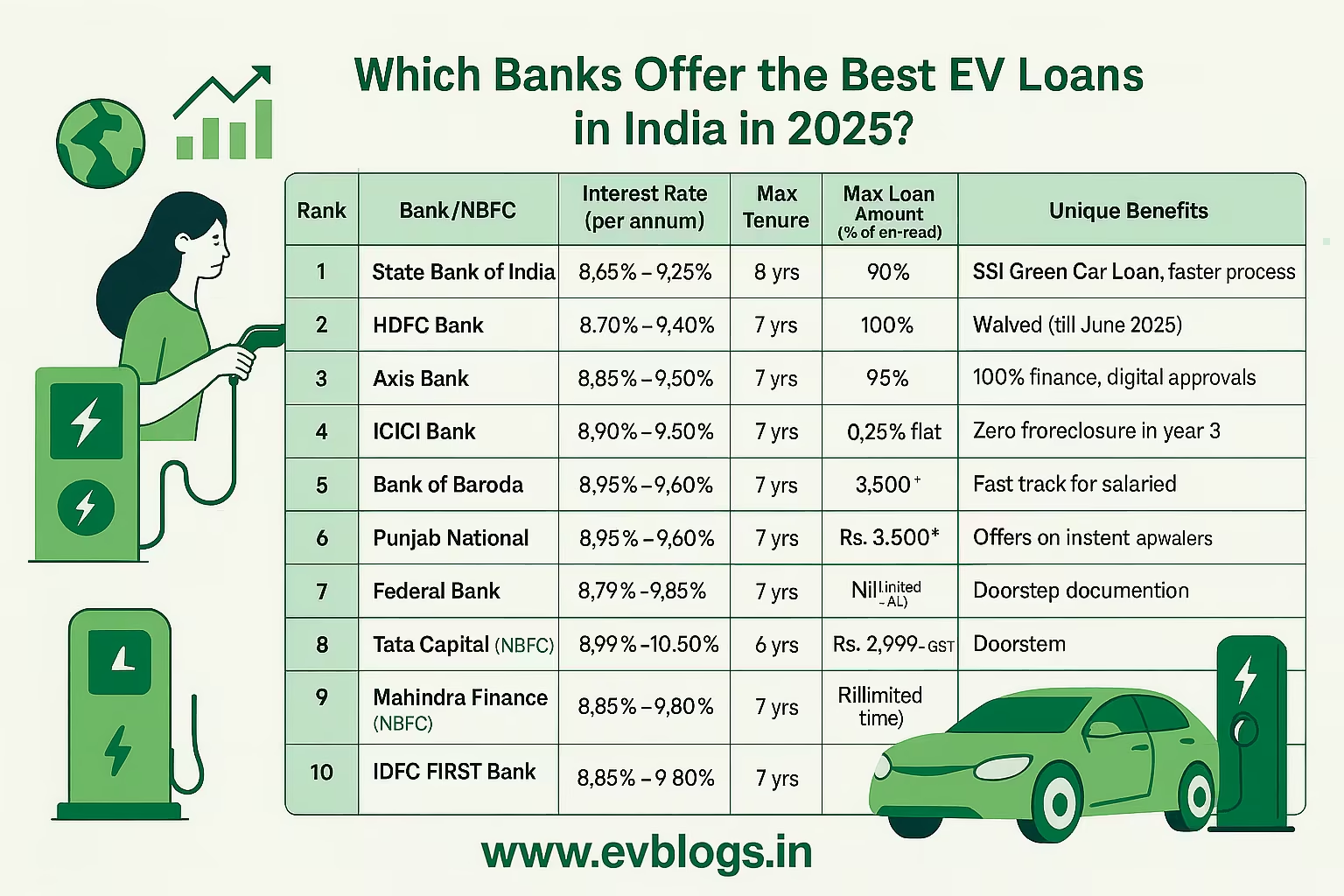

Comparing Top Banks at a Glance (2025 Snapshot)

| Bank | Min Interest Rate | Max Tenure | Max Loan (% of cost) | Processing Fee |

|---|---|---|---|---|

| SBI | 8.75% | 8 years | 90% (on-road) | Nil or low |

| HDFC | 9% | 7 years | 100% (ex-showroom) | ₹3,000–₹5,000 |

| Axis | 9.25% | 7 years | 90% | As per bank norms |

| ICICI | 9% | 7 years | 100% | ₹3,499 and up |

| PNB | ~8–9% | 7 years | 85% | Low |

Who Should Choose What?

- Urban Professionals – Go for HDFC or SBI for quick, simple green loans.

- Fleet Operators – PNB or Canara with bulk loan capacity and business support.

- Tier-II/III Two-Wheeler Buyers – Use NBFCs like Hero FinCorp for local approvals.

- First-Time Car Buyers – ICICI’s digital pre-approved offers are user-friendly.

Frequently Asked Questions (FAQ)

Q1. What is the average interest rate of EV loans in India?

A: Around 8–10% p.a. in 2025, lower than petrol/diesel loans due to green lending push.

Q2. Do I need a bigger down payment for EV loans?

A: No, most lenders now finance 90–100% of the EV price.

Q3. Can I get a loan on a second-hand EV?

A: Most banks don’t, but select NBFCs do with vehicle inspection.

Q4. How does my credit score impact my EV loan?

A: 700+ scores mean better approval and lower interest.

Q5. Is there tax benefit on EV loans?

A: Yes, under Section 80EEB, you can claim up to ₹1.5 lakh per year on interest.

Q6. Can I pre-close my EV loan?

A: Many banks allow zero pre-closure after a minimum EMI period—check your terms.

Conclusion: Making India’s Green Mobility Accessible Through Smart Banking Choices

The Indian government’s push towards sustainable transportation has opened unprecedented opportunities—not just in vehicle innovation but also in how we finance our mobility choices.

Whether you’re an urban commuter aiming for lower running costs and eco-friendly credentials—or a business owner eager to modernize your fleet—the right bank loan can bridge affordability gaps while maximizing benefits from ongoing policy incentives and technological advancements in the EV sector.

In summary:

- Compare not just interest rates but actual disbursal limits

- Pick a lender based on service speed and ease of approval

- Don’t forget tax advantages like 80EEB

- Monitor for state subsidies that could reduce cost further

The clean mobility age is here, and with these smart bank offerings, so is your chance to go electric—easily, affordably, and sustainably.