Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

What is the Electric Vehicle Insurance Cost in 2025 in India?

Electric Vehicle (EV) insurance is becoming more important each year in India as more people switch to green mobility. If you are planning to buy an electric car or bike in 2025, you definitely want to know how much insurance will cost, what factors impact the premium, and which options are best for you.

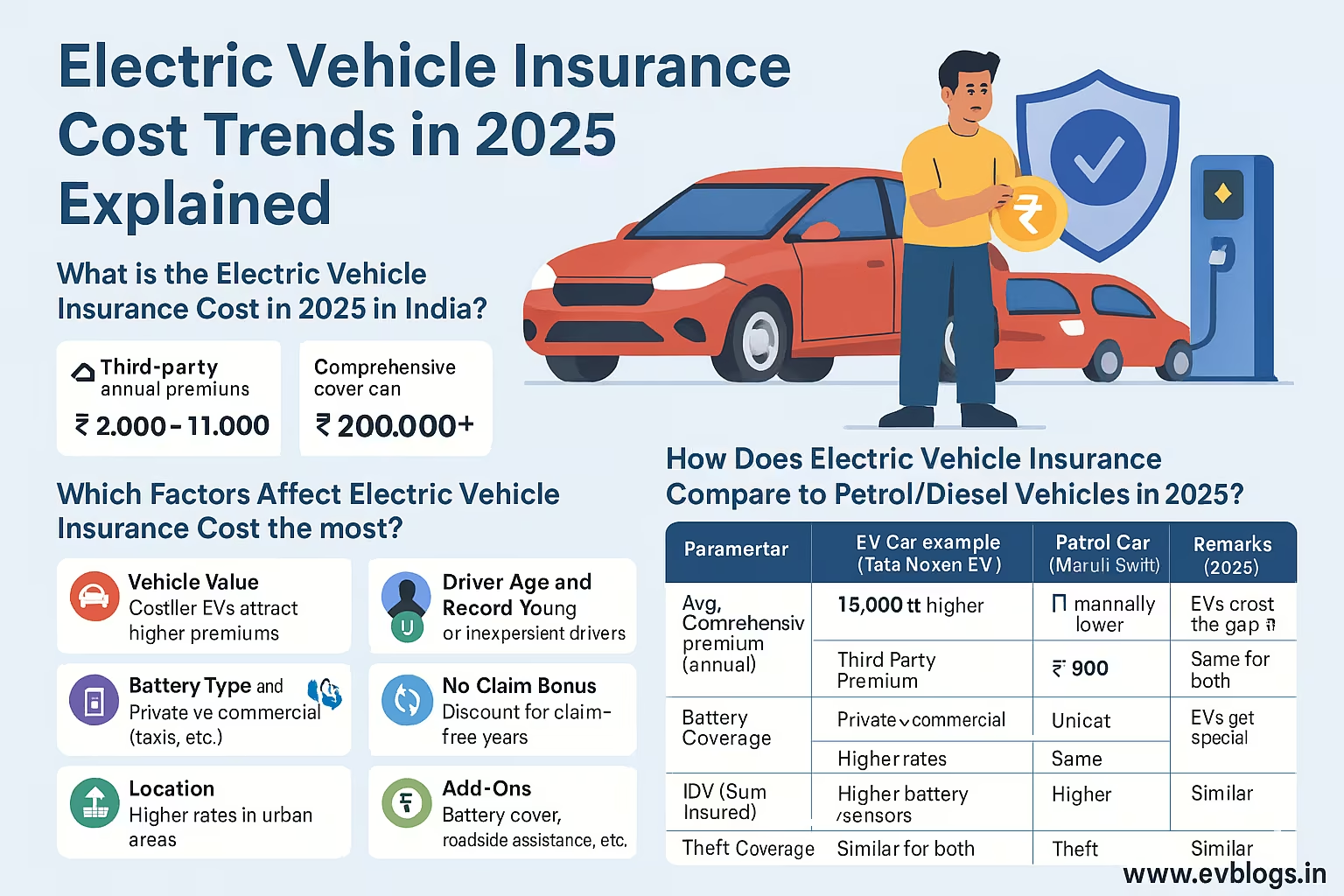

In 2025, the cost of insuring an electric vehicle in India is influenced by several factors — from the model and value of your EV to government subsidies and specific EV-centric schemes. According to IRDAI and industry data, average third-party annual premiums for electric cars range from ₹2,000 to ₹11,000, while comprehensive cover can go upwards of ₹20,000 for premium models. For EV two-wheelers, expect premiums between ₹800 and ₹4,500.

Let’s break down everything you need to know, so you can make a smart, informed decision about your EV insurance in 2025.

Did You Know?

According to the Ministry of Road Transport and Highways (MoRTH), the number of registered electric vehicles in India crossed 3.5 million by early 2025—resulting in a spike in demand for specialized EV insurance options.

Why is Electric Vehicle Insurance Important in India in 2025?

Getting an insurance policy for your electric vehicle isn’t just a legal formality in India. It’s a necessity to protect you financially, especially as replacement parts for EVs (like battery packs and advanced sensors) can be costly.

Here’s why you need EV insurance in 2025:

- Mandatory by Law: Like petrol/diesel vehicles, third-party insurance is legally required as per the Motor Vehicles Act.

- Protection from High Repairs: EV-specific components (especially batteries) are expensive. Insurance cushions these costs.

- Liability Coverage: Protects you from financial claims due to accidents, property damage, or third-party injuries.

- Theft and Natural Disasters: Comprehensive policies safeguard against theft, floods, fire, and more.

- EV-specific Coverages: Includes issues unique to EVs, like battery replacement, charging infrastructure, or flying objects affecting the battery.

Additional points to consider:

- Rising EV Incidents: With more EVs on the road, accident and theft statistics have shown a slight upward trend in top cities in 2025.

- Government Focus: State and central governments continue supporting EV ownership via insurance subsidies or GST reductions in 2025.

Expert Insight

“In 2025, insurers in India have started partnering with OEMs like Tata, Mahindra, and Ather to tailor packages covering battery repairs, roadside EV charging, and even coverage for charging cables.”

Which Factors Affect Electric Vehicle Insurance Cost the Most?

Several variables directly influence how much you will pay for your EV insurance in 2025. Knowing them helps you make smarter choices and possibly save money.

Key factors include:

- Vehicle Value: Costlier vehicles (like Tata Nexon EV or BYD Atto 3) attract higher premiums.

- Battery Type and Capacity: Bigger/more advanced batteries are costlier to replace, so insurance goes up.

- Usage Type: Private vs commercial use (taxis, delivery bikes) impacts premiums.

- Location: Urban areas (Delhi, Mumbai, Bengaluru) usually see higher premiums due to higher theft, accident rates.

- Driver Age and Record: Young or new drivers may pay more; those with zero-claim histories often get discounts.

- IDV (Insured Declared Value): Higher IDV means higher claims payout, so premiums increase.

- No Claim Bonus: Consistent safe drivers can get up to 50% discount over multiple claim-free years.

- Add-Ons: Battery protection, roadside assistance, EMI protection, and accessories cover can raise costs but boost your peace of mind.

How Does Electric Vehicle Insurance Compare to Petrol/Diesel Vehicles in 2025?

One of the most common questions is: “Do EVs cost more or less to insure compared to petrol/diesel vehicles in India now?” Let’s compare in detail.

| Parameter | EV Car Example (Tata Nexon EV) | Petrol Car Example (Maruti Swift) | Remarks (2025) |

|---|---|---|---|

| Avg. Comprehensive Premium (annual) | ₹15,000 | ₹12,000 | EVs slowly closing the gap |

| Third Party Premium | ₹6,500 | ₹7,900 | EVs marginally lower |

| Battery Coverage | Included (add-on) | Not required | Unique to EVs |

| Roadside Assistance | Enhanced (for charging) | Basic | EVs get special services |

| IDV (Sum Insured) | Higher (due to battery) | Standard | EV battery boosts value |

| No Claim Bonus | Up to 50% off | Up to 50% off | Same for both |

| Repairs & Spare Costs | Higher for battery/sensors | Moderate | Impacts claim payout |

| Theft Coverage | Similar | Similar | Risk is equal |

Key points to note:

- In 2025, insurance for EVs is only about 10-15% higher than for petrol/diesel vehicles — this gap is reducing each year.

- New IRDAI guidelines have encouraged more coverage options, battery protection, and easy claim settlement for EVs.

- Many insurers offer exclusive green discounts for EV policyholders.

Did You Know?

State governments like Delhi and Maharashtra offer additional discounts or rebates on EV insurance premiums for new registrations in 2025.

What are the Latest Electric Vehicle Insurance Premium Rates in 2025?

Here are the latest indicative annual insurance costs for top-selling electric cars and two-wheelers in India for 2025. This should help you budget based on your shortlisted EV.

| EV Model | Type | Third-Party Premium (₹) | Comprehensive Premium (₹)* | Battery/EV Add-on (₹) |

|---|---|---|---|---|

| Tata Nexon EV | SUV | 6,500 | 15,000 | 2,000 |

| MG ZS EV | SUV | 9,000 | 21,000 | 3,000 |

| Mahindra XUV400 | SUV | 8,200 | 19,500 | 2,500 |

| Hyundai Kona Electric | Crossover SUV | 11,000 | 24,500 | 3,800 |

| BYD Atto 3 | SUV | 10,500 | 27,000 | 4,200 |

| Tata Tiago EV | Hatchback | 4,700 | 11,800 | 1,500 |

| Citroen eC3 | Hatchback | 4,500 | 11,200 | 1,600 |

| Tata Tigor EV | Sedan | 4,900 | 12,000 | 1,700 |

| Ather 450X | E-Bike | 2,200 | 5,200 | 700 |

| Ola S1 Pro | E-Scooter | 1,900 | 4,700 | 600 |

| TVS iQube | E-Scooter | 1,800 | 4,500 | 600 |

| Bajaj Chetak | E-Scooter | 2,000 | 4,900 | 650 |

*Comprehensive Premium is for first-year, private use, insured declared value as per ex-showroom prices.

- Premiums can be lower if you have NCB or opt for voluntary deductibles.

- Battery/EV add-ons are priced yearly and can differ based on model and battery size.

Details and insurance highlights:

- Tata Nexon EV: India’s top-selling EV in 2025; premium reflects battery coverage and theft protection demand.

- MG ZS EV: Costlier due to bigger battery and advanced connected tech.

- Mahindra XUV400: Mid-range SUV, competitive insurance, good for families.

- BYD Atto 3: Higher due to imported parts and battery costs.

- Hatchbacks (Tiago EV, eC3): Lower premiums suited for urban use.

- Two-wheelers: Ather, Ola, TVS and Bajaj offer good deals with city-use add-ons.

Expert Insight

Some insurers in 2025 provide loss of battery cover or swap station support—useful if your EV relies on battery swapping as with some two-wheeler fleets.

When Should You Renew or Buy Electric Vehicle Insurance in 2025?

Timing your insurance policy is crucial for uninterrupted coverage, and maybe some savings.

Here’s what you should keep in mind:

- New Purchase: Always insure your EV before taking delivery; dealers can facilitate, but compare direct online rates for better deals.

- Annual Renewal: Renew before expiry to avoid loss of No Claim Bonus (NCB) and to stay legally compliant.

- Switching Insurers: You can change insurers at renewal, especially if you find better battery coverage, add-ons, or lower premiums elsewhere.

- Battery Replacement: If you replace the EV battery (a major expense), inform your insurer—they may adjust IDV and premium.

Tips to optimize:

- Use online quote comparison tools in 2025—IRDAI e-insurance platforms now list all insurers’ EV products.

- Early renewals (15-30 days before expiry) may attract added discounts.

What Add-ons and Features Should You Consider for EV Insurance in 2025?

EV owners today have access to add-ons tailored for electric vehicles. Choosing the right add-ons not only improves your coverage but also directly impacts your final premium.

Popular add-ons for EVs in 2025:

- Battery Protection Cover: Shields you against damage to or replacement of battery packs due to accidents, theft, fire, or even short-circuits.

- Zero Depreciation: Prevents deduction for parts’ depreciation in settlement—crucial for expensive EV components.

- Charging Cable & Wall Charger Cover: Coverage for theft/damage of portable chargers and cables.

- Roadside Assistance (EV-specific): On-spot battery jump-starters, mobile charging, and towing to the nearest authorized charging station.

- Consumable Cover: For coolant/fluid replacements, which are different from ICE vehicles.

- EMI Protection: Pays your loan EMIs if your vehicle is in the garage after an accident for a long period.

- Personal Accident Cover (Owner-Driver): Higher sum insured options in 2025 due to rising medical costs.

Remember, each add-on typically increases the premium. Only pick what matches your usage pattern and budget.

Why is Battery Protection Vital for EV Insurance in India?

Batteries are the most expensive part of an EV—accounting for nearly 35-45% of the total vehicle cost. A failed or damaged battery can mean a potential expense of ₹3-7 lakh for premium cars in 2025. That’s why you must check if battery coverage is included or available as an add-on in your insurance policy.

Key points for 2025:

- Most insurers now offer “Battery Replacement Cover” as a standard add-on.

- Some even cover battery degradation beyond a certain capacity drop (as verified by OEM diagnostics).

- Battery warranty provided by manufacturers is usually for 8 years or 1.6 lakh km, but insurance kicks in for accidental, theft, or fire-related loss.

Did You Know?

In 2025, some insurers have started offering “Battery Leasing Insurance”—ideal if you own an EV under a battery-leasing plan like certain fleet operators.

How Can You Lower EV Insurance Premiums in 2025?

While EV insurance is a must, everyone wants to pay less for it. Here’s how you can get the best value:

- Compare Online: Use IRDAI-endorsed aggregator platforms to get quotes from 15+ insurers instantly.

- Maintain Good Driving Record: Zero-claims history ensures up to a 50% No Claim Bonus by year 5.

- Opt for Higher Voluntary Deductible: You share more in case of any claim, so the insurer lowers the premium.

- Install Approved Security Devices: ARAI-certified trackers or immobilizers can fetch 8-15% off.

- Club All Drivers Under One Policy: For families, clubbing multiple drivers/cars under one umbrella policy may attract discounts.

- Check for State EV Subsidies: Some states like Karnataka and Gujarat offer special insurance discounts.

- Skip Unwanted Add-ons: Only pick covers you will actually use.

Which are the Top 10 Electric Vehicle Insurance Providers in India (2025) and How Do They Compare?

Knowing who the leading insurers are—and what each offers—can save you time and money.

| Company | Market Share (%) | Unique EV Features (2025) | Claim Settlement Ratio | Avg. Comprehensive Premium (Sedan EV) | Battery Cover Included? | Digital Claim Process |

|---|---|---|---|---|---|---|

| ICICI Lombard | 18 | Special EV-only plans, cashless at 9000+ garages | 97.3 | ₹12,100 | Yes | Yes |

| Bajaj Allianz | 15.5 | App-based claims, battery cover standard | 96.9 | ₹11,800 | Yes | Yes |

| HDFC ERGO | 13.2 | Own-damage cashless, green rewards | 98.1 | ₹12,700 | Yes | Yes |

| Tata AIG | 11.9 | Partnership with Tata EVs, 24x7 roadside | 97.8 | ₹13,200 | Yes | Yes |

| Future Generali | 9.5 | EV roadside service, online renewals | 95.2 | ₹12,400 | Optional | Yes |

| Reliance General | 8.8 | Quick approval, EV repair partners | 96.2 | ₹12,900 | Optional | Yes |

| SBI General | 7.3 | Pan-India cover, owner-driver add-ons | 97.0 | ₹11,600 | Yes | Yes |

| Digit Insurance | 5.5 | Minimal paperwork, cheapest rates | 93.7 | ₹10,900 | Optional | Yes |

| IFFCO Tokio | 4.8 | Doorstep survey, rural coverage | 95.8 | ₹11,500 | Optional | Yes |

| New India Assurance | 4.5 | Government-backed, trusted for fleets | 95.0 | ₹11,100 | Optional | Yes |

Detailed comparison and reasons to choose:

- ICICI Lombard: Best for urban EV owners due to widest cashless network and high settlement.

- Bajaj Allianz: Good for those who prefer app-based claims and standard battery coverage.

- HDFC ERGO: Top choice for reliability; offers green rewards for eco-friendly habits.

- Tata AIG: Partners directly with Tata Motors, seamless claim for Tata EVs with battery swaps.

- Future Generali: Easy online renewals, suitable for tech-savvy users.

- Reliance General: Quick claim approvals and tie-ups with most repair centres.

- SBI General: Trusted by government employees, offers strong add-ons.

- Digit Insurance: Low paperwork, great for young EV buyers.

- IFFCO Tokio: Efficient for rural or tier-2/3 city owners.

- New India Assurance: Preferred by companies and large EV fleets.

Disclaimers:

- Premiums and features may vary by city and personal driving profile.

- Always check latest details before purchase.

How Does the Claim Process Work for Electric Vehicle Insurance in 2025?

Claiming insurance for EVs is much easier in 2025, thanks to digitization and EV-specialist claim desks.

Steps you should follow:

- Inform Your Insurer: Immediately after an incident (accident, theft, etc.).

- Digital Photo/Video Upload: Most insurers allow you to upload photos/videos via their app or website for assessment.

- Garage Approval: Cashless claim or repair at authorized service center — many now have EV-trained mechanics.

- Battery Related Claim: Special survey usually conducted; battery is sent to a certified checker if needed.

- Settlement: Fast-track settlements for EVs — average time in 2025 is 4-6 working days for simple cases.

- Document Upload: Aadhaar, RC, policy copy, and any police FIR (in case of theft/accident).

Tips for smooth claim:

- Always use authorized workshops, especially for battery repairs (to keep OEM warranty intact).

- Keep all vehicle software updates and diagnostics records — some insurers ask for battery health proof.

- Track claim status online or on insurer app.

Expert Insight

90% of EV insurance claims in 2025 (by leading insurers) are processed digitally, with dedicated claim managers for battery or electronics-related disputes.

What Real-Life User Experiences and Case Studies Exist for EV Insurance in India 2025?

First-hand stories are the best way to understand what to expect.

User Experience 1:

Anita, Bangalore — Tata Nexon EV Owner

- Insured her car with Bajaj Allianz in early 2024 for ₹13,500 (comprehensive, with battery cover).

- Had a minor parking accident, required bumper and sensor replacement—claims process was fully app-based.

- Repairs and settlement within 5 days at a cashless workshop.

User Experience 2:

Nikhil, Mumbai — Ola S1 Pro Owner

- Opted for Digit Insurance’s basic battery add-on (₹500 extra).

- Experienced battery malfunction within warranty; insurance assisted with diagnostics fee and cable replacement.

- “Customer service was helpful in coordinating with Ola service center.”

User Experience 3:

Prakash, Hyderabad — Mahindra XUV400 Fleet Operator

- Renewed through ICICI Lombard, used No Claim Bonus for all 5 EVs in his fleet.

- Utilized 24x7 roadside assistance when one car stalled near a rural highway—on-site mobile charging support provided.

User Experience 4:

Simran, Delhi — Hyundai Kona Electric

- Switched insurer at renewal from Future Generali to SBI General, motivated by lower premium and inclusion of wall charger coverage.

- Filed a claim for theft; claim was approved after FIR and all digital evidence shared.

Which Government Policies and Incentives Affect EV Insurance in 2025?

Central and state governments in India are giving major pushes to EV adoption, and insurance is part of their strategies for making EV ownership more affordable.

Policies impacting insurance in 2025:

- GST on Insurance Premium: GST rate remains 18%, but some states provide partial refund as part of EV incentive.

- Central FAME-II Extensions: Insurance rebates for fleet buyers in several metro cities.

- Delhi/NCR and Maharashtra: Up to 15% premium discount on first-year EV insurance for new buyers.

- No Road Tax States: States like Telangana, Karnataka, and Tamil Nadu waive road tax for EVs; some also bundle discounted insurance offers.

- Green Number Plate: Quick claim approval track for EVs registered with a green plate (verifiable on VAHAN database).

Did You Know?

The IRDAI introduced new standard EV insurance product guidelines in late 2024, resulting in lower third-party premiums for mass-market EVs (cars and two-wheelers) by 8-10% in 2025.

How to Choose the Best Electric Vehicle Insurance Policy in 2025?

Making the right insurance choice for your EV in 2025 is about more than just saving a few rupees. It’s about ensuring you get maximum coverage, top claim support, and tailored add-ons.

Some easy steps to follow:

- Assess Your EV’s Needs: For premium EVs, ensure comprehensive battery cover. For city runabouts, perhaps focus on theft & charging accessories.

- Use Official Comparison Tools: IRDAI’s e-insurance portal lists all registered insurers and allows quick plan comparisons.

- Check Claim Settlement Ratios: Always pick a company with at least 95%+ claim settlement.

- Read User Reviews: 2025’s reviews on portals like PolicyBazaar, BankBazaar, or IRDAI’s consumer feedback section.

- Look for Fast Claim Support: Tech-savvy insurers or those endorsed by EV manufacturers (like Tata AIG for Tata EV) usually process claims quicker.

- Add-Ons Relevance: Only pay extra for what matches your usage (e.g., daily commuters should consider EMI protection).

- Affordability vs Service: Cheapest isn’t always best—balance cost with service/practical coverage.

Some tips for Indian users:

- For entry-level or first EVs (like Tiago EV, eC3), prioritize affordability and theft cover.

- For urban users, roadside EV charging support is a must.

- For fleets/commercial users, look at special group EV insurance schemes.

Final Verdict: What Should You Do About EV Insurance Costs in India for 2025?

Whether you plan to buy an EV or already own one, insurance is a necessity—not a luxury. In 2025, Indian insurers have made big progress in offering tailored, affordable, and tech-enabled policies for EV owners.

- EV insurance costs are competitive, now only slightly higher than ICE vehicles.

- Pick add-ons like battery cover and roadside EV assistance to stay worry-free.

- Compare at least 4-5 top insurers and use online tools to optimize your premium.

- Don’t forget to claim No Claim Bonus at renewal each year.

- Stay updated with state-specific incentives, as you might get additional insurance discounts just for going green.

The best decision? Choose a policy giving you maximum value—not just the lowest price. Standardize your own checklist (coverages, claim speed, add-ons) and you’ll enjoy peace of mind as you drive into India’s electric future!

5 More FAQs on Electric Vehicle Insurance Cost in 2025

Q1: Is electric vehicle insurance compulsory in India in 2025?

Yes, at least third-party insurance is mandatory for all EVs as per the Motor Vehicles Act.

Q2: Does battery warranty cover insurance claims?

No, manufacturer battery warranty covers only defects; insurance helps in accidental, theft, or disaster-related battery damage.

Q3: Will my premium increase if I frequently use public charging stations?

No, insurance costs are not linked to charging habits, but frequent use in risky locations may impact future claims assessment.

Q4: Are there special policies for EV taxis or fleets?

Yes, commercial EV usage plans exist, with bulk discounts and priority roadside support, especially for ride-share or food delivery vehicles.

Q5: Does installing solar-powered EV charging at home affect insurance?

Not directly, but you can get add-ons to cover damage to wall chargers or fire risk, which should be discussed with the insurer.

Still have questions? Use IRDAI’s e-insurance platforms for live support or consult your EV dealer for the latest insurance tie-ups and offers in 2025. Enjoy your green drive, worry-free!