Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

Electric Vehicle Subsidy in Andaman and Nicobar Islands: A 2025 Guide

Introduction: Introduction to Driving Green in the Islands.

With the world turning to sustainable mobility, electric cars (EVs) have already become a light of hope when it comes to tackling climate change and lowering reliance on fossil energy. The most important place where this shift is essential is the ecologically sensitive areas such as the Andaman and Nicobar Islands. The islands, having a weak ecosystem, a small fuel logistics, and an expanding personal transportation market, are the only ones located to enjoy EV adoption.

The e-mobility drive by the Government of India combined with the state initiatives has given the inhabitants of the islands an opportunity to adopt green transportation. The primary concept of this movement is the electric vehicle subsidy, a financial aid aimed at render the EV available and attractive. This article provides an in-depth examination of the working of these subsidies in Andaman and Nicobar Islands as of 2025, who is eligible to receive the subsidies, eligibility requirements, application procedures, academic views, and practical suggestions to the locals.

Electric Vehicle Subsidies in Andaman and Nicobar Islands: What to know.

What is an EV Subsidy?

A government-supported monetary award that decreases the initial price of an EV. These subsidy may be direct (cash discounts), indirect (tax exemptions or lower registration charges), or both. India EV subsidies are offered through the central government Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme with many local policies.

Why Are Subsidies Important for Island Communities?

- High Fuel Costs: The island transportation is exaggerated with the import logistics.

- Environmental Susceptibility: Internal combustion engines aggravate the pollution hazards in sensitive environments.

- Energy Security: Energy independence in the local context is enhanced by decreasing the use of imported fuels.

- Tourism Impact: Clean transport facilitates eco-tourism- which is a significant economic pillar.

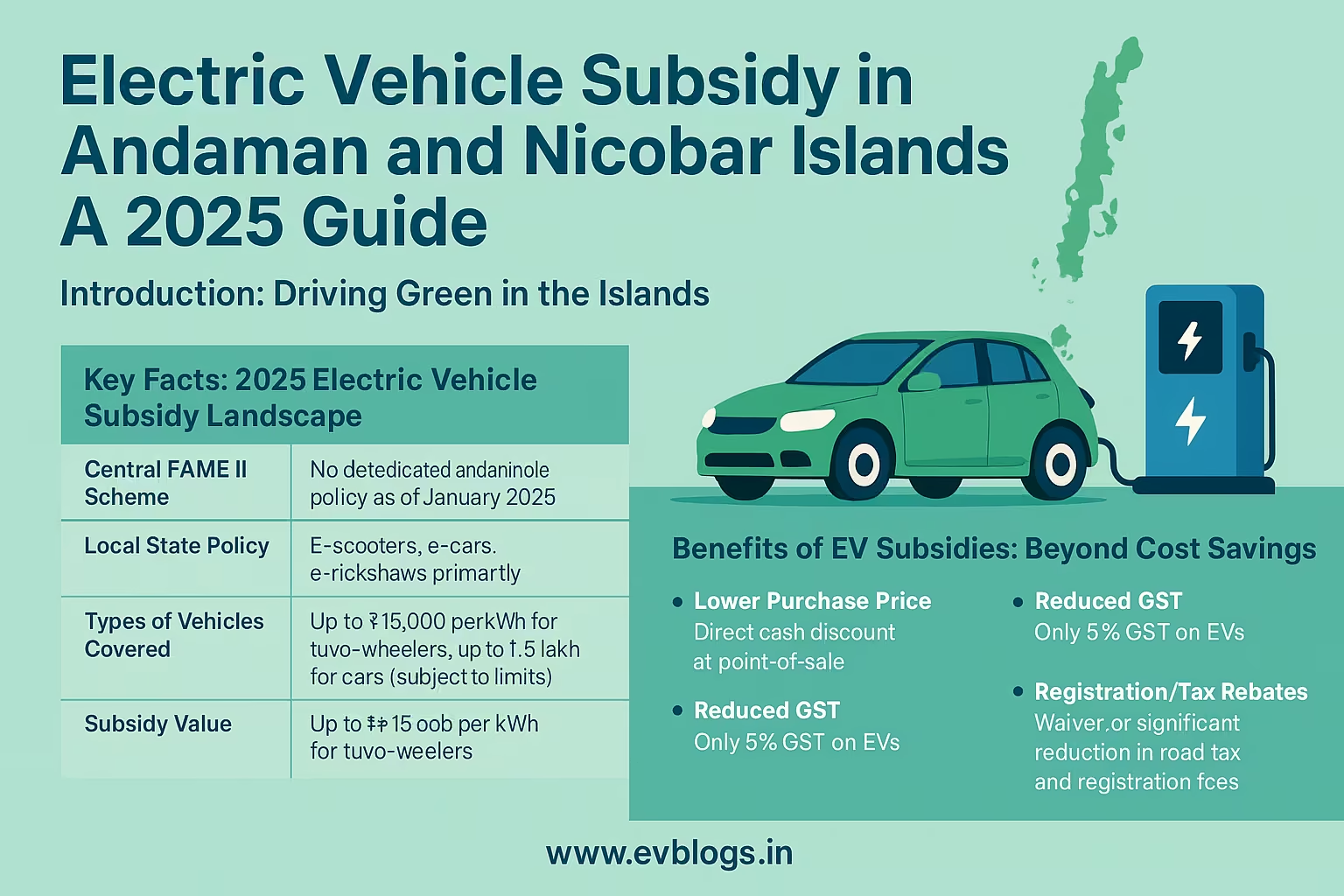

Key Facts: 2025 Electric Vehicle Subsidy Landscape

| Aspect | Details (As of 2025) |

|---|---|

| Central FAME II Scheme | Extended till 31.03.2027; 2, 3, 4-Wheelers |

| Local State Policy | No independent stand-alone policy as of January 2025; central benefits available |

| Types of Vehicles Covered | E-scooters, e-cars, e-rickshaws primarily |

| Subsidy Value | Two-wheelers up to ₹15,000 per kWh; cars up to ₹1.5 lakh (limited) |

| Other Incentives | GST at 5%; Income tax benefit under Sec 80EEB |

| Charging Infrastructure | Expanded; Port Blair and large towns have public charging points |

Eligibility Criteria: Who Can Avail EV Subsidy?

General Eligibility

- Resident status: Central subsidies can be enjoyed by any Indian citizen who lives in Andaman Nicobar Islands.

- Type of Vehicle: Only locally registered vehicles which are certified in FAME II will be eligible.

- Participation of the manufacturer/dealer: Under FAME II, the car has to be bought at an authorized OEM/dealer.

Specific Requirements

- Initial Enrollment: Restricted to new automobiles.

- Non-commercial Use: Some incentives apply only to private buyers.

- Maximum Limit: One vehicle per individual under subsidy norms.

Documentation Needed

- Proof of identity (Aadhaar card/passport/voter ID)

- Proof of residence (local address proof)

- Purchase invoice

- Bank account details

- Dealer/OEM certification

Benefits of EV Subsidies: Beyond Cost Savings

Financial Advantages

- Lower Purchase Price: Direct cash discount at point-of-sale.

- Reduced GST: Only 5% GST on EVs versus higher rates on petrol/diesel vehicles.

- Registration/Tax Rebates: Waiver or significant reduction in road tax and registration fees.

Environmental & Social Benefits

- Reduced air and noise pollution—critical in biodiversity hotspots.

- Lower carbon footprint across tourism and local commuting sectors.

- Encourages clean-energy jobs and skills development.

Long-Term Ownership Perks

- Reduced running costs due to cheaper electricity.

- Rare maintenance requirements since EVs have fewer moving parts.

- Section 80EEB allows income tax deduction of up to ₹1.5 lakh loan interest.

Procedure: EV Subsidy Step-by-Step How to Avail of

A resident can take advantage of available subsidies in the following way:

Research Model Options

Confirm eligibility under FAME II via official website or dealer.Choose a Model at an Authorized Dealer

Ensure the dealer is FAME II compliant.Prepare Required Documents

Gather ID, residence proof, bank details, and purchase invoice.Purchase Formalities

Dealer applies subsidy as upfront discount.Registration & Tax Exemption

Register with local RTO; road tax waiver may apply.Access Additional Benefits

Claim Sec 80EEB tax deduction during ITR if purchased on loan.

Experts: What Industry Leaders Say

Dr. Nikhil Kumar (Mobility Researcher)

“Islands such as Andaman have special logistical issues of fuel supply. Subsidies lower costs, reduce environmental damage, and strengthen energy security.”Rina Das (Local Dealership Manager)

“Interest in e-scooters is rising. Subsidies give instant savings at checkout.”Transport Department Official (A&N Administration)

“Our priorities are expanding charging infra and EV adoption. New fast-charging stations will come up in Port Blair this year.”

Practical Advice & Tips for Residents

Before You Buy

- Check charging options at home/public.

- Test drive on local terrain.

After Purchase

- Use service packages from dealers.

- Stay updated on policy tweaks.

Use-Cases Specific to Island Life

- Daily Commuting: E-scooters ideal for short distances in Port Blair.

- Tourism Operators: E-rickshaws popular with eco-tourists.

- Home to School Runs: Small e-cars are safe and low-maintenance.

In contrast to Mainland Policies

| Feature | Mainland States with Extra Policy | Andaman & Nicobar Islands |

|---|---|---|

| Central FAME II Subsidy | Yes | Yes |

| State-Level Cash Incentive | Varies by state | Not yet |

| Road Tax Waiver | In many states | As per UT notification |

| Charging Infra Density | Higher | Expanding |

Common Challenges & Solutions

Threat: Few charging stations outside Port Blair

Solution: Plan routes and install home chargers.Challenge: Higher upfront cost

Solution: Total cost of ownership shows breakeven in ~3 years.Challenge: Lack of awareness

Solution: Attend local workshops/demo rides organized by transport dept.

FAQ: Real-world Answers About EV Subsidies in Andaman & Nicobar Islands

Q1: Is there a special state subsidy?

No, only central FAME II benefits as of early 2025.

Q2: Are tourists eligible?

No, only residents with local address proof.

Q3: How long to receive subsidy?

Immediate at point-of-sale, no reimbursement delays.

Q4: Are commercial operators eligible?

Yes, for e-rickshaws and fleet cars registered locally.

Q5: Are scrappage benefits included?

Not yet in A&N, may come via future national policies.

Q6: Any support for home chargers?

No local grants yet, but some utilities offer concessional setup.

Conclusion: Greener Future Begins with You

To the inhabitants and commercial ventures on the Andaman and Nicobar Islands, it could not be more convenient or more significant to take up the option of an electric vehicle. There is strong financial and environmental merit with front loading price cuts through FAME II subsidies, continued tax cuts, reduced running expenses, and growing infrastructure support. With an increasing policy momentum extending into 2025 and further, and with rising awareness, transitioning to clean mobility will serve to protect these beautiful islands and improve the quality of life of all the people that call them home.

You can think about buying an electric vehicle this year:

- Begin by research on viable models,

- Refer to dealers involved,

- Claim all the financial advantages you could find and join a cleaner future today.

Sources

- Ministry of Heavy Industries – FAME India Scheme Phase II

- Andaman & Nicobar Transport Department Notifications – Andaman Govt Transport

- Central Board of Direct Taxes – Income Tax Deductions Section 80EEB

- Press Information Bureau – EV Policy Updates

- Society of Manufacturers of Electric Vehicles – SMEV Reports