Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

Electric Vehicle Subsidy in Tripura: A Complete Guide for 2025

Introduction: Why Electric Vehicles Matter in Tripura

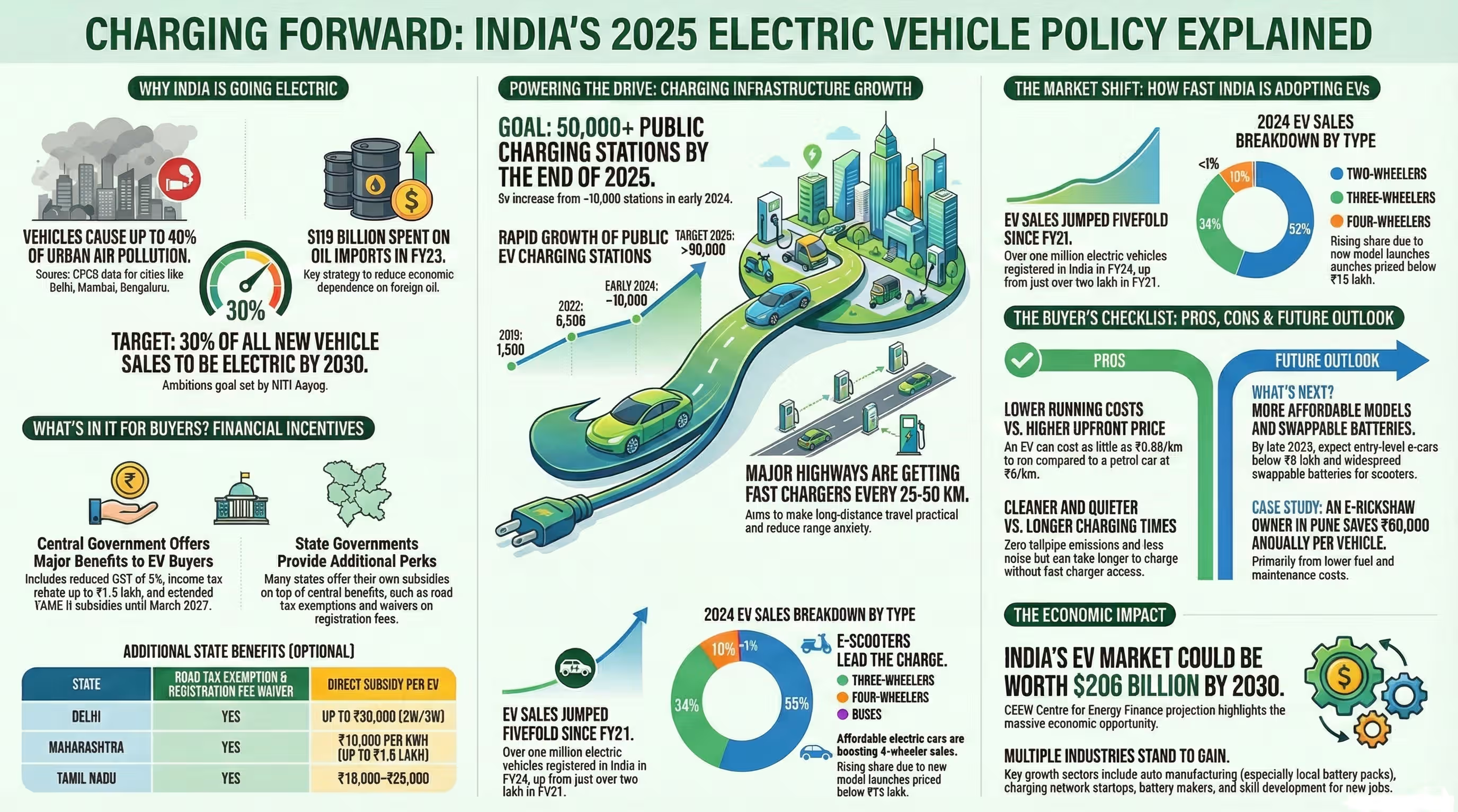

India’s transition to electric vehicles (EVs) is at a critical juncture, and the northeastern state of Tripura is stepping up its efforts to lead this change. With concerns over rising fuel prices, urban air pollution, and climate change, more individuals and businesses in Tripura are considering EVs as a practical alternative to conventional vehicles.

The Government of Tripura has recognized this shift and introduced a series of subsidies and incentives to make electric vehicles more accessible and affordable. Understanding these subsidies—who is eligible, what benefits are on offer, and how to apply—can help residents make informed decisions and contribute to the state’s cleaner, greener future.

This guide aims to provide comprehensive, up-to-date information about Tripura’s electric vehicle subsidy landscape as of 2025, blending real-world context with actionable advice for residents.

Understanding the EV Revolution in Tripura

Tripura, located in India’s northeast, faces unique challenges: limited fossil fuel resources, high fuel transportation costs, and rapidly growing urban centers like Agartala that struggle with air pollution. As a part of India’s broader push under the FAME II (Faster Adoption and Manufacturing of Hybrid & Electric Vehicles) scheme and its own state-level policies, Tripura is striving to:

- Reduce dependency on imported fossil fuels

- Improve local air quality

- Promote sustainable mobility

- Create green jobs through new industries

Recent Trends

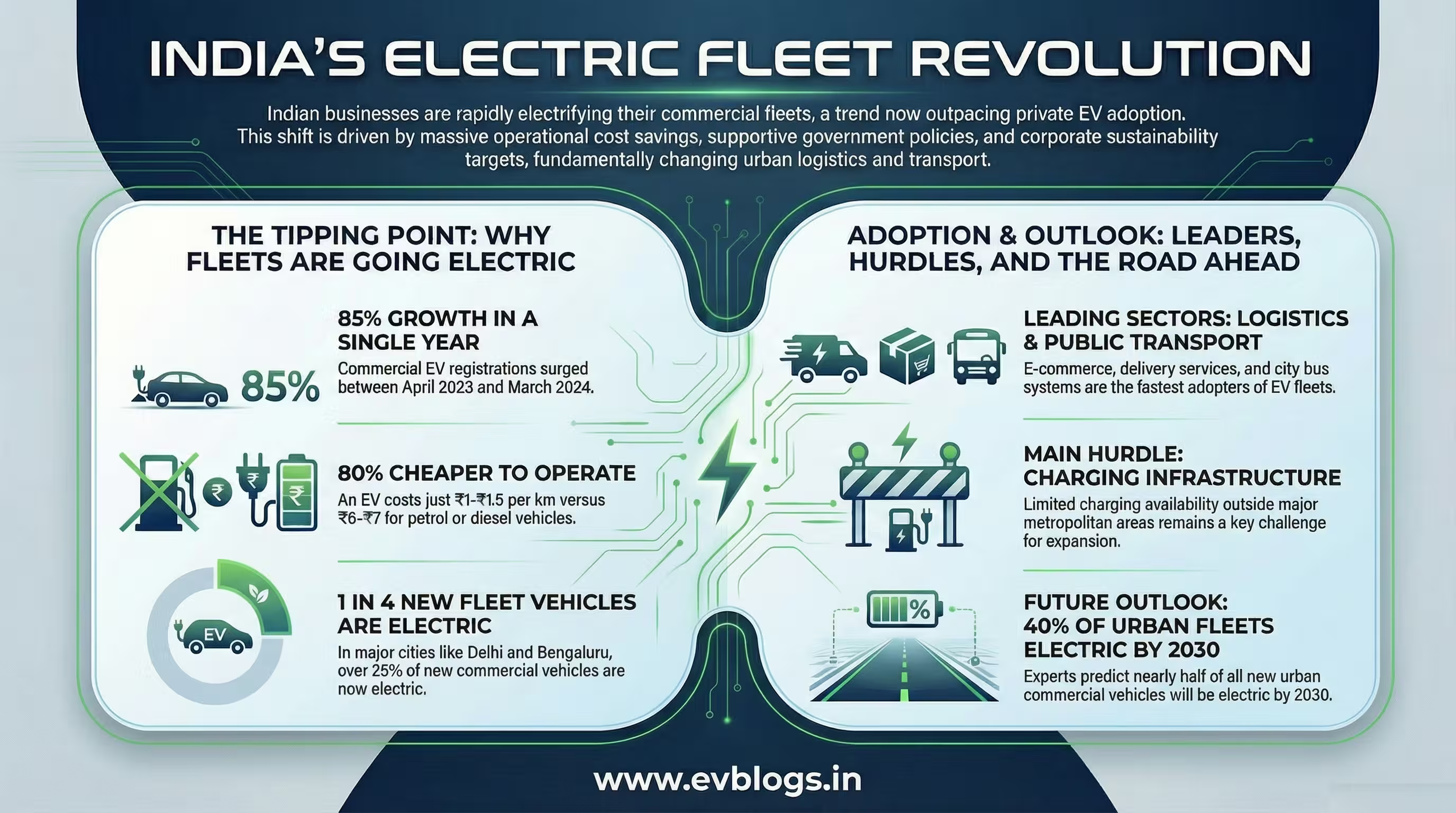

In 2024-25, sales of electric two-wheelers and three-wheelers in Tripura saw a significant uptick. Local taxi operators have begun replacing diesel auto-rickshaws with e-rickshaws, while government offices are switching their fleets to electric cars. The state’s capital city Agartala now features several public EV charging stations—a key step toward mass adoption.

Key Facts About Electric Vehicle Subsidies in Tripura

- State Policy Name: “Tripura Electric Vehicle Policy 2022” (updated for 2025)

- Applicable Vehicles: E-two wheelers (bikes/scooters), e-three wheelers (rickshaws), electric cars (personal & commercial), e-buses.

- Subsidy Type: Direct purchase incentive + tax waivers + registration fee exemptions

- Target Groups: Individual buyers, commercial fleet operators, government departments

- Coordinating Authority: Department of Transport, Government of Tripura

Who Is Eligible for the EV Subsidy?

Understanding eligibility is crucial before planning your EV purchase. The main categories include:

1. Individual Buyers

- Residents of Tripura with valid ID/address proof.

- Must purchase an eligible EV model registered within the state.

- Only one subsidy per person/household per vehicle segment.

2. Commercial Entities & Fleet Operators

- Registered companies or partnerships operating in Tripura.

- Fleets used for public transport or goods carriage (e.g., taxi aggregators).

- Must comply with local employment requirements for drivers/operators.

3. Special Groups

Additional preference/subsidy top-ups may be provided to:

- Women buyers

- Persons with disabilities

- Rural entrepreneurs setting up e-mobility businesses

Note: Vehicles purchased under Central Government FAME II incentives are also eligible for state subsidies—benefits can be combined but not duplicated.

What Are the Benefits? Subsidy Structure Breakdown

Tripura’s EV subsidy program offers multiple layers of benefits designed to reduce both upfront and recurring costs:

A. Upfront Purchase Subsidy

| Vehicle Type | State Subsidy (per vehicle) | Central FAME-II Subsidy | Maximum Combined Benefit |

|---|---|---|---|

| E-Two Wheeler | Rs. 10,000 – Rs. 20,000 | Up to Rs. 15,000 | Rs. 35,000 |

| E-Three Wheeler | Rs. 30,000 – Rs. 50,000 | Up to Rs. 50,000 | Rs. 1 lakh |

| E-Car (Personal) | Rs. 50,000 | Varies by model | Up to Rs. 1 lakh+ |

| E-Car (Commercial) | Up to Rs. 1 lakh | Varies | Upwards of Rs. 1 lakh |

| E-Bus | Custom/project basis | Significant central support | Case-by-case |

Amounts are indicative and may vary based on battery capacity & model.

B. Registration & Road Tax Exemption

All new EVs registered from April 2022 onwards are exempt from:

- Registration fees (one-time)

- Road tax for up to five years (can be extended)

C. Charging Infrastructure Support

Subsidies/grants available for:

- Setting up home/public charging stations

- Commercial charging operators get capital support & license fee waivers

D. Special Incentives

Additional benefits may include:

- Priority parking spots in city centers

- Green number plates

- Relaxed permit requirements for commercial e-rickshaws/taxis

The Step-by-Step Process: How To Avail The Subsidy in Tripura

Navigating government incentives can seem daunting; here’s a simplified roadmap:

Step-by-Step Guide:

Step 1: Choose an Eligible Vehicle Model

Ensure your preferred EV is listed under both FAME II-approved models and those recognized by the Tripura Transport Department.

Step 2: Visit Authorized Dealer

Purchase your vehicle from an authorized dealership participating in the subsidy program.

Step 3: Submit Required Documents

Typically includes:

- Proof of residence in Tripura (Aadhaar card/voter ID/ration card)

- PAN card/identity proof

- Purchase invoice & payment receipt

- Bank account details

Dealers often assist by uploading documents on official portals.

Step 4: Application Processing

Your documents are verified by the dealer and then submitted online via the state’s dedicated portal or at RTO counters.

Step 5: Vehicle Registration

On verification approval:

- You receive exemption from registration fees/road tax automatically.

- Green number plates are issued.

Step 6: Subsidy Disbursement

The direct benefit is typically credited post-purchase into your bank account within a stipulated time (usually within three months).

Step 7: Avail Additional Benefits

If you wish to set up a home charger or apply for commercial permits/infrastructure grants, follow separate application processes via the Department of Power/Transport.

Tip: Always keep digital copies/scans of all documents handy!

Expert Insights: Making Sense of EV Incentives in Practice

To provide people-first value beyond policy summaries:

What Do Experts Recommend?

Dr. Rajat Dey – Environmental Scientist at NIT Agartala

“Tripura’s policy is among the most progressive in the northeast region because it integrates direct subsidies with infrastructural development—public charging stations will be pivotal for mass adoption.”

Ms. Smita Paul – Owner of an Agartala-based E-Rickshaw Fleet

“The process was smoother than expected; our business saved over Rs. 8 lakhs through combined central-state subsidies last year alone.”

Mr. Animesh Debbarma – Automobile Dealer

“Customers should look out for models that optimize battery range over just price—total cost savings over five years can be substantial when you include road tax waivers.”

Practical Advice: Maximizing Your EV Savings in Tripura

To ensure you get full benefit from available subsidies:

Tips for Buyers:

- Combine State and Central Benefits: Confirm with your dealer that both FAME II and state subsidies will be applied—this can nearly halve certain vehicle costs.

- Check Latest Eligible Models: New models get added regularly; always confirm updated lists before booking.

- Leverage Charging Support: If you have parking space at home/apartment societies—apply early for home charger grants.

- Plan Ownership Duration: Road tax exemption lasts five years; holding onto your EV longer increases overall savings.

- Consider Total Cost-of-Ownership: Factor fuel savings (~Rs.1/km vs petrol/diesel), reduced maintenance needs, tax breaks.

- Understand Resale Value: While resale markets are nascent now, demand for used EVs is projected to rise as awareness spreads.

Comparing With Other States: How Does Tripura Stack Up?

Compared to neighboring states like Assam or Meghalaya:

| Feature | Tripura | Assam | Meghalaya |

|---|---|---|---|

| Max Two-wheeler Subsidy | Up to Rs.20K | Up to Rs.20K | Up to Rs.10K |

| Road Tax Waiver | Yes (5+ yrs) | Yes | Yes |

| Commercial Fleet Focus | Strong | Moderate | Moderate |

| Public Charger Grants | Yes | Limited | Yes |

| Application Ease | Online + Dealer-assisted | Mostly Online | Offline/Online |

Tripura matches—and sometimes exceeds—peer states on individual buyer benefits while being more aggressive on infrastructure support for commercial e-mobility operators.

Use Cases: Who Benefits Most From These Incentives?

Real-world examples illustrate how different residents can maximize value:

Case Study A – Urban Commuter

A college lecturer in Agartala buys an electric scooter costing Rs.95,000 ex-showroom:

- State subsidy = Rs.15,000

- Central subsidy = ~Rs.12,000

- Total cost after subsidy = ~Rs.68,000

- Additional savings from zero registration fees & road tax (~Rs10k) over five years.

Case Study B – Rural Entrepreneur

A rural youth sets up a fleet of five e-rickshaws:

- Total central + state benefit = ~Rs2 lakhs per vehicle

- Lower running costs mean quicker break-even point versus diesel rickshaw fleet

- Eligibility for priority loans under Mudra Yojana further sweetens deal.

Frequently Asked Questions (FAQ)

Q1: Can I avail both central FAME-II subsidy and state subsidy together?

Yes; both incentives can be combined if you meet eligibility conditions.

Q2: How long does it take to receive the subsidy amount after purchase?

Usually between one to three months post-registration/document approval.

Q3: Are used/second-hand electric vehicles eligible?

No; only new vehicles registered first time within Tripura qualify.

Q4: Is there any income limit or special eligibility requirement?

No income limit applies currently; however some schemes prioritize special groups like women or rural entrepreneurs.

Q5: Can I buy an out-of-state EV model and claim subsidy?

No; vehicles must be purchased from authorized dealers within Tripura who participate in the program.

Q6: Are charging station installation grants available for residential apartments?

Yes; RWAs/societies can apply via designated forms on Transport/Power department portals subject to technical feasibility.

Conclusion: Your Next Steps Toward Greener Mobility

Tripura’s robust electric vehicle subsidy framework makes it easier than ever before for residents—from daily commuters to business owners—to switch confidently toward clean mobility solutions while saving significantly on costs.

If you’re considering making the leap:

- Research eligible models thoroughly.

- Visit authorized dealers who have experience with subsidy claims.

- Prepare all documentation beforehand.

- Stay updated through Transport Department notifications as policies can evolve yearly based on budget allocations.

- Consider long-term value—not just upfront discounts—in your decision-making process.

By embracing these incentives today, you’re not only investing wisely but also helping shape a sustainable future for yourself—and all of Tripura—for years ahead.

Sources

- Tripura Transport Department – Official Announcements

- FAME India Scheme Phase II Guidelines

- Tripura State Electric Vehicle Policy PDF

- Press releases & interviews published by local media outlets such as The Northeast Today and The Indian Express (2024–2025 coverage)

- Ministry of Heavy Industries & Public Enterprises reports on EV adoption trends