Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

What is an EV Loan Subsidy in India?

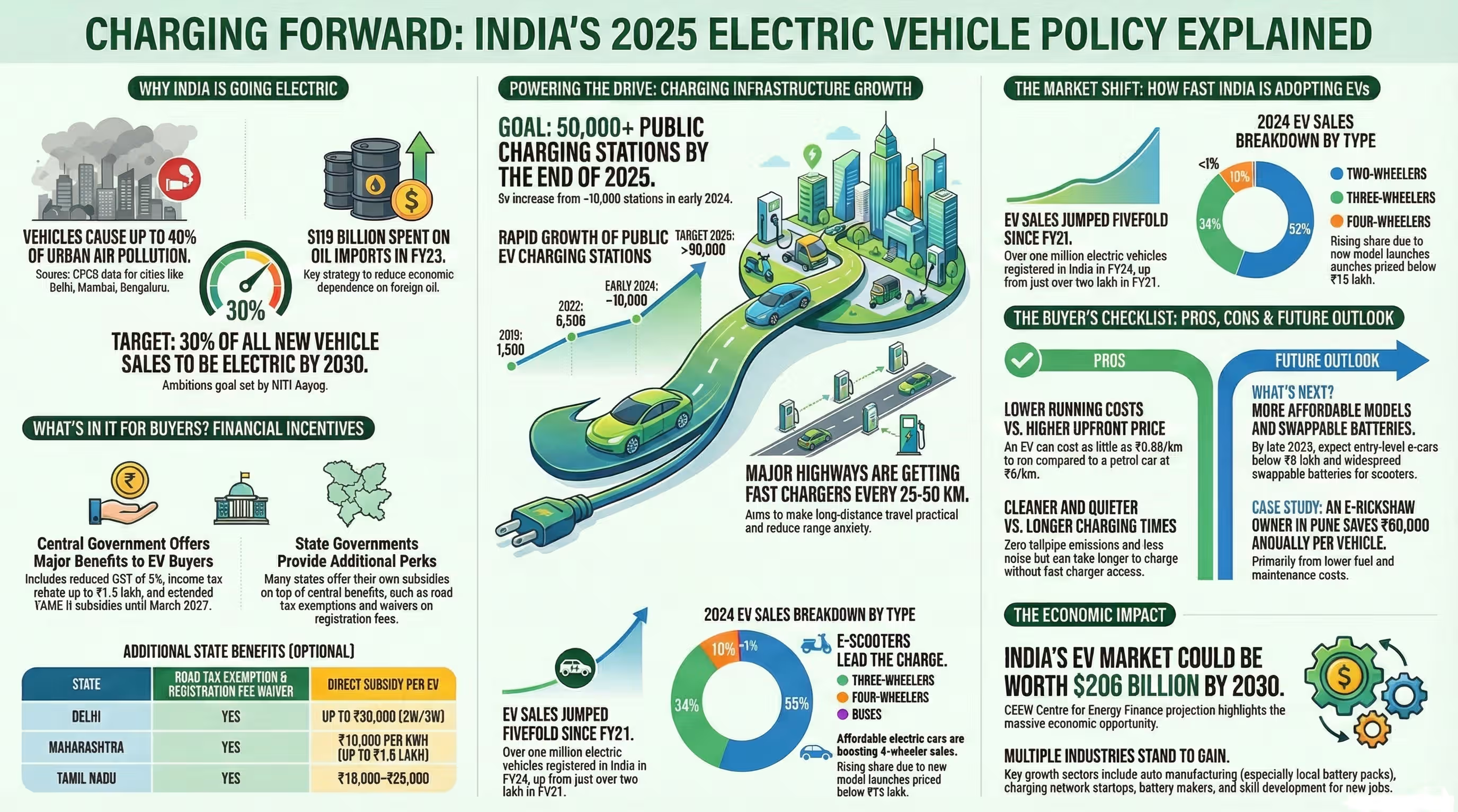

An EV (Electric Vehicle) loan subsidy in India is a financial support program offered by the Indian government and some states. This program helps you reduce the cost of buying an electric vehicle. The aim is to make EVs more affordable for Indian customers and to increase adoption as part of the country’s sustainable mobility mission.

When you apply for an EV loan subsidy, some part of your vehicle purchase (or its loan interest) is borne by the government through direct incentives or by offering lower interest rates on loans. The most well-known subsidy program in India is the FAME II (Faster Adoption and Manufacturing of Electric Vehicles) scheme, which continues until March 2025, with some updates expected for 2025.

- The Government of India and several state governments cover a specific amount based on the type of EV (two-wheeler, four-wheeler, commercial vehicle, etc.).

- Personal as well as commercial buyers can benefit from these subsidies if you meet eligibility requirements.

- Typically, the subsidy is available as an upfront discount on the vehicle invoice or as interest savings on the loan, depending on the specific scheme and financier.

Main EV Subsidy Benefits in India

- Saves you ₹10,000 to ₹1,50,000 per vehicle, depending on category and state.

- Reduces loan interest rates by 1%-3% in some banks.

- Pushes for more EV charging infrastructure.

- Promotes greener lifestyle and significant fuel savings.

Did You Know?

As of 2025, India offers up to ₹15,000 per kWh as a subsidy for electric two-wheelers, capped at 20% of ex-showroom price under FAME II.

Why Apply for an EV Loan Subsidy in 2025?

Applying for an EV loan subsidy in 2025 can bring you several personal and financial benefits, making your transition to an electric vehicle smoother and more affordable.

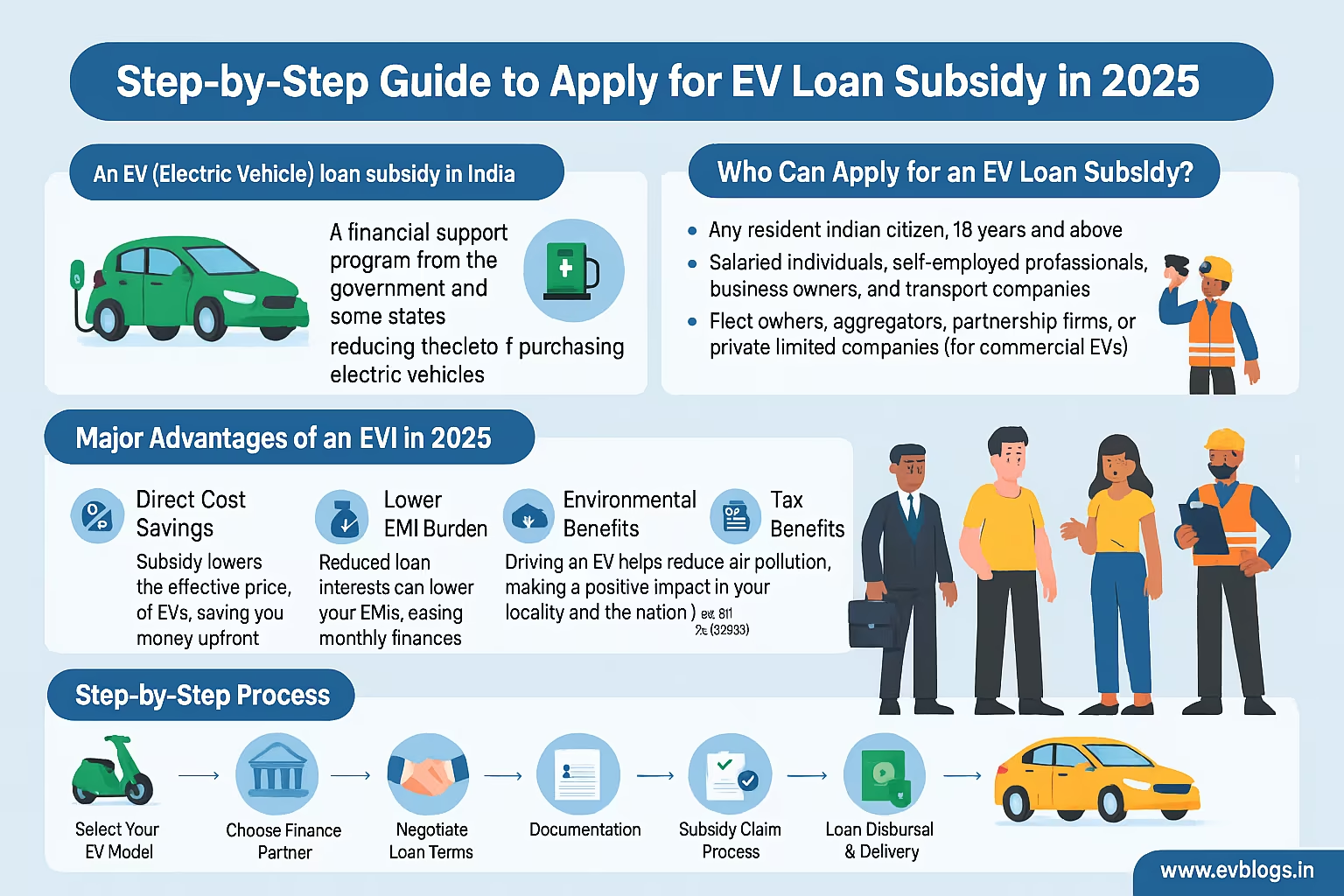

Major Advantages

- Direct Cost Savings

- Subsidy lowers the effective price of EVs, saving you money upfront.

- Lower EMI Burden

- Reduced loan interests can lower your EMIs, easing monthly finances.

- Environmental Benefits

- Driving an EV helps reduce air pollution, making a positive impact in your locality and the nation.

- Tax Benefits

- Deductions up to ₹1.5 lakh under section 80EEB for EV loan interest (as per Income Tax Act, 2025).

- Future-Proof Investment

- As ICE vehicles face tighter norms and possible bans in certain cities, EVs offer a more sustainable and regulation-friendly choice.

Why the Urgency in 2025?

- The central FAME II subsidy is set to undergo major review in March 2025—early buyers may benefit more.

- More state-specific subsidies may close as adoption rates rise.

Expert Insight

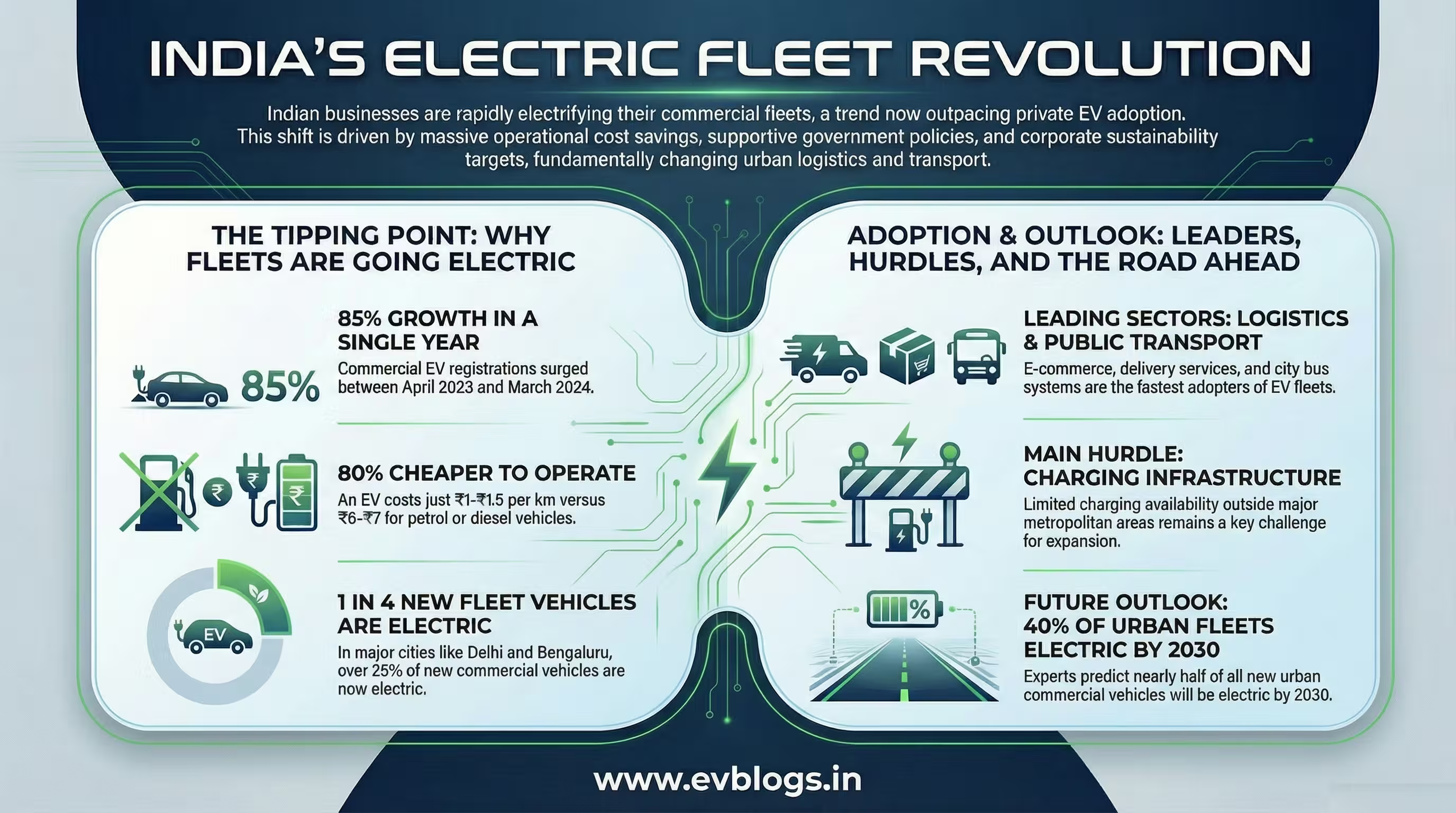

According to the Ministry of Heavy Industries, EV sales in India crossed 21 lakh units in FY 2024-25—a 42% jump over the previous year, largely thanks to subsidies.

Who Can Apply for an EV Loan Subsidy in India?

Eligibility is key to ensure you get the benefits. Here’s who can apply:

Eligible Applicants

- Any resident Indian citizen, 18 years and above.

- Salaried individuals, self-employed professionals, business owners, and transport companies.

- Fleet owners, aggregators, and partnership firms or private limited companies (for commercial EVs).

- Some subsidies specifically for first-time EV buyers.

- You must have a valid PAN card, Aadhaar card, and proof of income.

Which Vehicles are Supported?

- Registered and certified EVs (as per CMVR 1989 Rules).

- Only those EVs listed under the FAME II or respective state schemes.

- Two-wheelers, three-wheelers, four-wheelers, and commercial EVs (bus, trucks, autos).

Not Eligible

- Imported or modified vehicles not recognized under Indian laws.

- Vehicles purchased for resale quickly after subsidy claim (can attract penalties).

When is the Best Time to Apply for EV Loan Subsidy?

Timing matters a lot! Knowing the right moment can increase your benefits.

Best Application Periods

- Before March 2025: The FAME II phase and many state subsidies may change or end after this.

- Festive Seasons: Banks and NBFCs (Non-Banking Financial Companies) often launch special EV loan rates and offers.

- Post-GST Rate Cuts: Sometimes, tax changes make it even cheaper—track policy updates.

Application Windows

- Loan and subsidy schemes accept applications year-round, but the best offers have deadlines or quotas.

- Check for city/state-specific windows if you’re in Delhi, Maharashtra, Gujarat, Karnataka, or Tamil Nadu.

Did You Know?

In 2025, some banks process EV loan applications within 24-48 hours—faster than traditional car loans!

How to Apply for an EV Loan Subsidy in India?

This is the most important step! Here’s a detailed guide to help you get started easily.

Step-By-Step Process

- Select Your EV Model:

- Pick from vehicles eligible for subsidy under FAME II or your state scheme.

- Choose Finance Partner:

- Most leading banks (SBI, HDFC, Axis) and NBFCs offer specialized EV loans.

- Negotiate Loan Terms:

- Ask for ‘EV-specific’ loan terms—many banks have special lower interest products for EVs.

- Documentation:

- Provide KYC, income proof, vehicle quotation/invoice, bank statements, and PAN/Aadhaar.

- Subsidy Claim Process:

- For FAME II, the manufacturer usually reduces the subsidy amount directly from the ex-showroom price.

- For some state subsidies, you may need to register your purchase online and upload documents.

- Loan Disbursal & Disbursal Letter:

- Upon approval, the lender releases funds, often directly to the showroom or dealer.

- Final Registration & Delivery:

- Get the vehicle registered at your RTO; ensure the chassis and registration number is linked for subsidy claims.

Main Things to Watch Out For

- Some states like Gujarat and Delhi require pre-registration on their EV portals.

- The dealership usually assists throughout the subsidy claim. Always use authorized sellers.

- Keep a digital and hard copy of every document.

Online Application Portals

- FAME India Portal

- State portals (Delhi EV Portal, Maharashtra EV Portal, etc.)

- Some bank/NBFC partner websites

Expert Insight

Leading OEMs like Tata Motors and Ather Energy offer instant discount mechanisms at showrooms—making the subsidy availing process nearly seamless.

Which Banks and NBFCs Offer the Best EV Loan and Subsidy Combination in India (2025)?

Not all lenders are the same. Here’s how the top EV loan providers compare for 2025!

| Bank/NBFC | Interest Rate (p.a.) | Processing Fee | Max Tenure | Minimum Downpayment | 2025 Subsidy Support | Pre-closure charges | Application Time | Remarks |

|---|---|---|---|---|---|---|---|---|

| State Bank of India (SBI) | 8.75% | ₹1,500 | 7 Years | 15% | FAME II + Delhi/GJ | NIL (after 1 yr) | 24 hours | SBI Green Loan Product |

| HDFC Bank | 9.25% | ₹2,000 | 7 Years | 20% | FAME II/MH/KA/TN | 2% | 1-2 days | Special EV tie-ups |

| ICICI Bank | 9.10% | ₹1,999 | 5 Years | 15% | FAME II only | 2% | 1 day | Fast processing |

| Axis Bank | 9.00% | ₹2,050 | 5 Years | 18% | FAME II/MH | 2% | 2 days | Offers Flexipay |

| Tata Capital | 9.15% | ₹2,500 | 5 Years | 15% | FAME II + All states | 2% | 2 days | No prepayment penalty |

| Bajaj Finserv | 10.00% | ₹3,000 | 4 Years | 10% | FAME II | 3% | 1 day | Quick disbursal |

| Bank of Baroda | 8.80% | ₹1,999 | 7 Years | 20% | FAME II | NIL (after 1 yr) | 2 days | Green auto loan |

| Mahindra Finance | 11.00% | ₹2,200 | 5 Years | 10% | FAME II + rural areas | 3% | 2-3 days | Rural-focused |

| Hero FinCorp | 12.00% | ₹2,000 | 3 Years | 12% | FAME II-TW only | 3% | 1-2 days | Two-wheelers |

| Kotak Mahindra Bank | 9.65% | ₹2,500 | 7 Years | 20% | FAME II + Delhi | 2% | 1-2 days | Digital process |

Highlights and Details

- SBI Green Loans:

- Best for long tenure and 0 pre-closure after 1 year; supports most state/central subsidies.

- HDFC/ICICI/Axis Banks:

- Partner with leading EV brands for EMI schemes and support state-level subsidies.

- Tata Capital and Bajaj Finserv:

- Customer-friendly, fast approval, and support for both personal and commercial EVs.

- Hero FinCorp and Mahindra Finance:

- Ideal for rural buyers and those interested in two-wheelers or commercial vehicles.

Did You Know?

EV loan approvals have a 25% higher approval rate than regular car loans due to strong government push in 2025.

What Documents Do You Need for EV Loan and Subsidy Application?

To ensure a smooth process, keep these documents handy. Some banks may ask for additional paper, but this is the standard list for 2025.

For Individuals

- PAN Card (mandatory)

- Aadhaar Card / Voter ID (for address)

- Recent passport-size photographs

- Latest bank statements (3-6 months)

- Income proof (Salary slip/Form 16 for salaried; ITR for self-employed)

- Vehicle quotation/proforma invoice from authorized dealer

- Loan application form (from bank/NBFC)

- Proof of employment (optional basis)

- Electric utility bill/driving license (as extra ID)

For Companies/Fleet Owners

- Company PAN card

- Registration certificate/Partnership deed/MoA

- Corporate bank statements

- GST registration (if applicable)

- Board resolution authorizing purchase

For Subsidy Application (State-Level)

- Vehicle registration certificate (RC)

- State EV portal registration slip

- Purchase invoice indicating subsidy reduction

- Dealer’s certificate (if required by state)

Expert Insight

In Delhi and Gujarat, digital uploading of documents is mandatory in 2025. Keep everything scanned for faster processing!

Which States Offer the Best EV Loan Subsidies in 2025?

State-level schemes exist with varying benefits. Here’s a detailed comparison of top subsidy states for EV buyers in 2025.

| State | Two-Wheeler Max Subsidy | Four-Wheeler Max Subsidy | Special Benefits | Portal Link | Unique Features |

|---|---|---|---|---|---|

| Delhi | ₹20,000 | ₹1,50,000 | Free reg. & road tax | ev.delhi.gov.in | Fastest approval, Direct to A/C |

| Maharashtra | ₹10,000 | ₹1,00,000 | Early bird scheme | ev.mahatrastra.gov.in | Largest budget, scrappage benefit |

| Gujarat | ₹20,000 | ₹1,50,000 | Scrappage bonus | gcev.gov.in | Highest two-wheeler subsidy |

| Karnataka | ₹10,000 | Price-based | No road tax | n/a | Open to all, low on-paper process |

| Tamil Nadu | ₹10,000 | ₹1,50,000 | Interest subvention | tn.gov.in/transport | Focus on manufacturing, rural buys |

| Telangana | ₹10,000 | Price-based | Tax exemption | ev.telangana.gov.in | Hybrid vehicle support |

| Andhra Pradesh | ₹10,000 | Price-based | Road tax waivers | apev.gov.in | Good for three-wheelers |

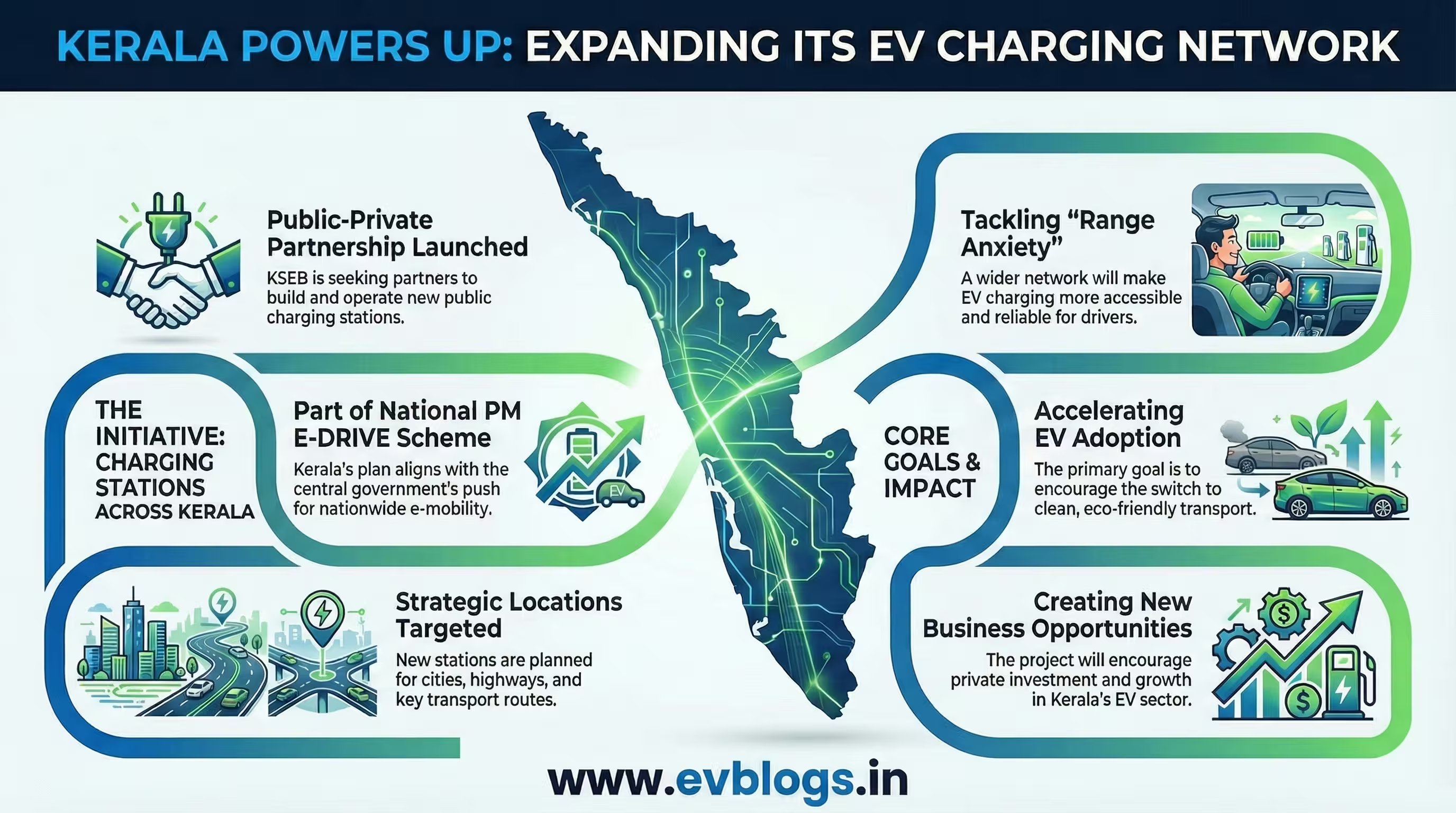

| Kerala | ₹10,000 | ₹1,50,000 | Tax-free | mvd.kerala.gov.in | Women buyers’ incentives |

| Haryana | ₹5,000 | Price-based | Road tax off | hryev.gov.in | Open for commercial EVs |

| Rajasthan | ₹5,000 | Price-based | Loan interest off | rajasthan.gov.in | Flexible scheme, city-wise capping |

In-Depth State Benefits

- Delhi:

- Among the highest upfront EV subsidies. Quickest disbursal (within 30 days), separate EV cell for consumer complaints.

- Maharashtra:

- Massive budget allocation—early buyers in FY 2025 can get extra cash-back scrappage incentives for old ICE vehicles.

- Gujarat:

- Excels for two-wheelers and three-wheelers; additional special schemes for students.

- Karnataka, Tamil Nadu, Telangana, Andhra Pradesh:

- Focus on total cost of ownership, making EVs attractive for commercial/fleet buyers.

- Kerala, Haryana:

- Lower but still meaningful, with extra perks (female buyers, fleet incentives).

- Rajasthan:

- Loan interest subsidies, especially for rural buyers and state employees.

Did You Know?

Gujarat boasts a special “Student EV Grant” for first-time student buyers—a unique initiative in India!

How Much Can You Save with EV Loan Subsidies in 2025?

Subsidies stack up—state, central, and sometimes manufacturer-driven offers. Here’s a realistic 2025 calculation:

Potential Savings Examples

Electric Two-Wheeler (ex-Delhi):

- Ex-showroom price: ₹1,20,000

- FAME II Subsidy: ₹22,500 (capped)

- Delhi State Subsidy: ₹20,000

- Net price: ₹77,500

- Loan EMI (5 years at 9%): ~₹1,600/month

Electric Car (ex-Maharashtra):

- Ex-showroom price: ₹12,00,000

- FAME II Subsidy: ₹1,50,000

- Maharashtra State Subsidy: ₹1,00,000

- Scrappage Benefit: ₹25,000 (exchange old car)

- Net price: ₹9,25,000

- Loan EMI (7 years at 8.8%): ~₹14,600/month

Electric Auto (ex-Gujarat):

- Ex-showroom price: ₹2,20,000

- Central FAME II: ₹40,000

- Gujarat Subsidy: ₹40,000

- Net price: ₹1,40,000

Tax Savings

- Deduct up to ₹1,50,000 on EV loan interest (Section 80EEB).

Expert Insight

In 2025, the combined central + state + scrappage subsidies can cover 30-50% of some EV models’ prices, a historic first for Indian buyers.

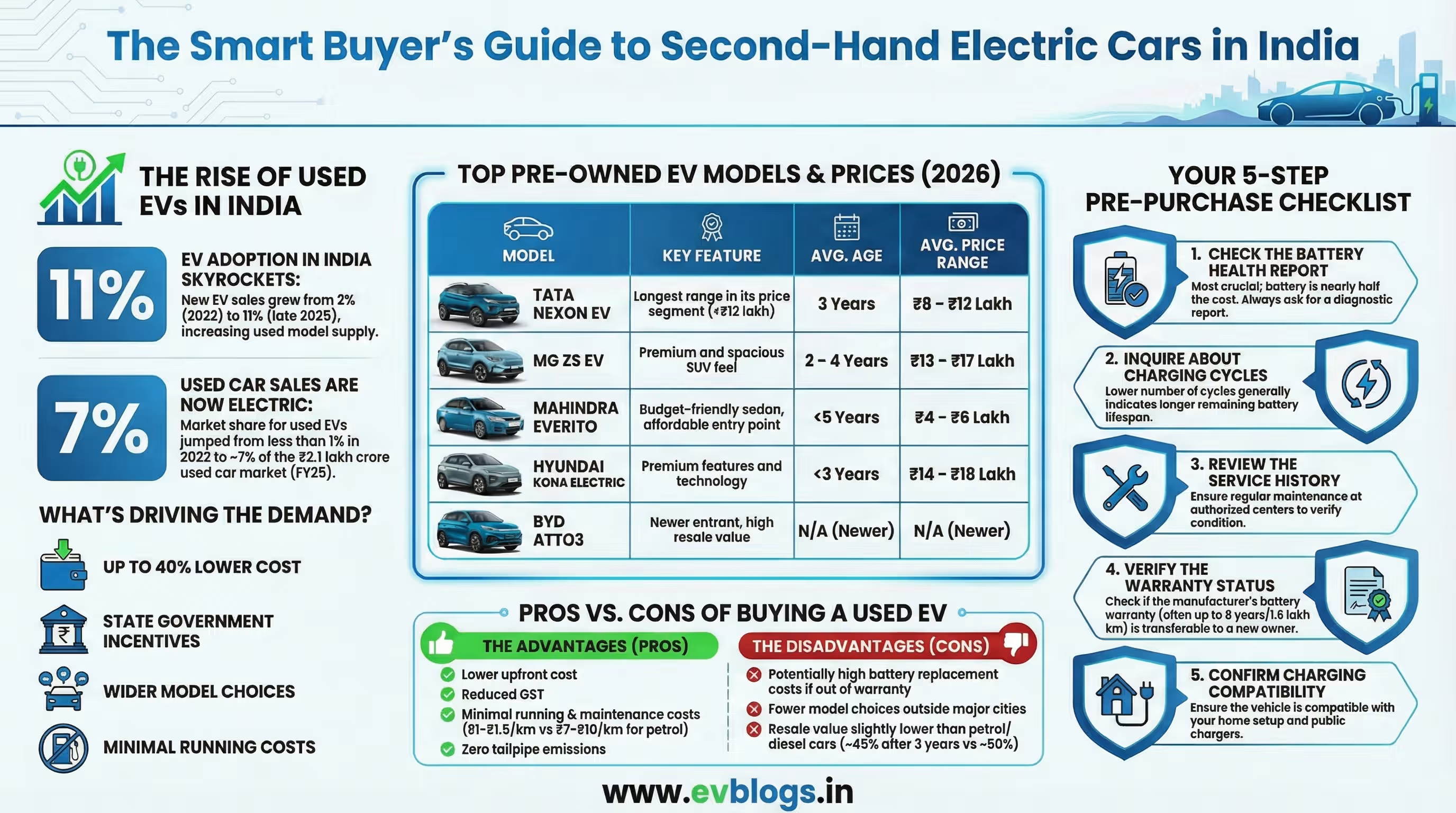

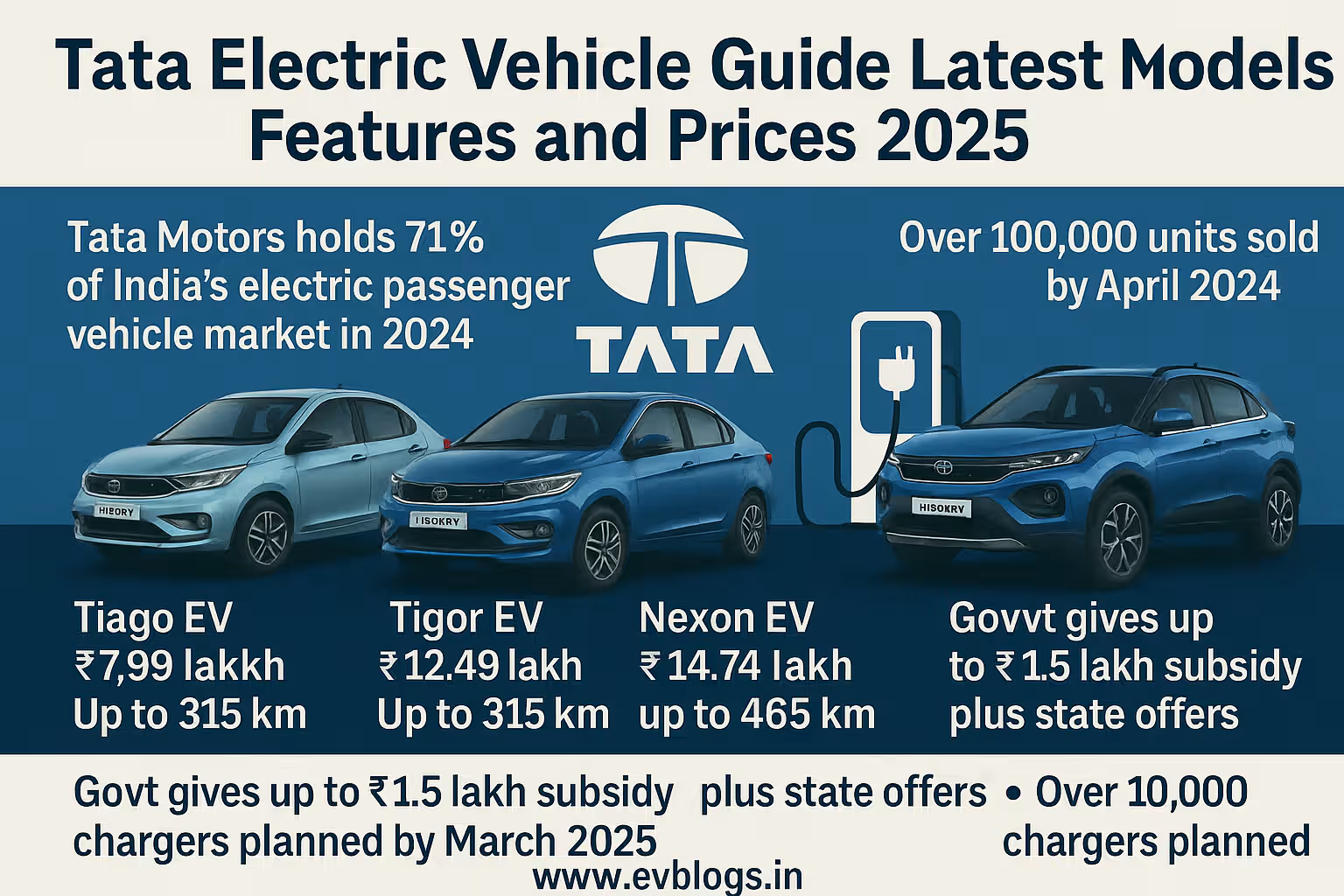

Which EV Models Are Eligible for Loan Subsidy in India (2025)?

Not every EV is eligible—you must choose from government-approved lists.

Popular Eligible EVs in 2025

Electric Cars

- Tata Nexon EV, Nexon EV Max, Tiago.ev

- MG ZS EV

- Hyundai Kona Electric

- Mahindra XUV400 Electric

- Tata Punch.ev

Electric Two-Wheelers

- Ola S1 Air/Pro

- Ather 450X/450S

- TVS iQube

- Bajaj Chetak Electric

- Hero Vida V1

Three-Wheelers

- Mahindra Treo

- Piaggio Ape E-City

- Kinetic Safar

Buses & Fleet EVs

- Tata Ultra EV Bus

- Ashok Leyland Electric Bus

- PMI Electro Bus

Manufacturers & Dealers

- Only buy from authorized dealers listed under FAME II.

- Complete lists available at FAME2 portal and respective state EV portals.

Did You Know?

In 2025, new additions include Tata Punch.ev and the latest Ather 450S, which get instant subsidies at point of sale!

How Does the EV Loan Subsidy Process Work—Step-By-Step Story

Hearing from actual users helps! Let’s walk through a recent user journey:

A True EV Owner’s Journey

- Preeti, a Delhi-based teacher wanted to upgrade to an electric car in January 2025. She chose Tata Tiago.ev (ex-showroom ₹9,00,000).

- She checked the FAME II portal and confirmed the model was eligible for ₹1,50,000 subsidy and Delhi EV Portal showed an additional ₹1,50,000.

- Applied online for a loan with SBI’s Green Loan scheme. The interest was 8.75% (lower than regular car loans).

- Submitted all documents: Aadhaar, PAN, salary slips, bank statements, and vehicle quote.

- The dealer deducted ₹3,00,000 from the cost upfront (showing proof of FAME II + Delhi subsidy).

- She paid ₹1,00,000 as downpayment, chose a 7-year EMI option at ₹10,500/month.

- Approval, disbursal, and delivery all done in 4 days.

- Preeti filed for tax deduction under 80EEB in March 2025.

Key Learnings

- Subsidies are instantly deducted, no long wait for cash-back.

- Banks increasingly offer ‘EV specialist’ support.

- Portal registration (especially Delhi, Maharashtra) is crucial for faster approvals.

- Having digital copies of your documents saves trouble.

What Common Mistakes Should You Avoid While Applying?

A few simple errors can lead to rejection or missed subsidies. Here’s what to avoid in 2025.

- Not checking the latest eligible EV model lists; these change every few months!

- Neglecting dealer’s status—always buy from gov-authorized showrooms.

- Submitting incomplete documentation—non-matching addresses, expired IDs, old pay slips delay approvals.

- Not registering purchase on state/city EV portal (required in several states).

- Choosing conventional car loan instead of special EV loan products.

- Missing ‘early bird’ deadlines in your respective state.

- Not reading loan terms—higher pre-closure fees, hidden charges, or missed insurance add-ons.

Did You Know?

Between 2023-2025, nearly 18% of Delhi EV subsidy claims were delayed due to wrong or incomplete portal registrations.

What Are the Tax and Financial Impacts of Applying for an EV Loan Subsidy?

An EV loan affects your taxes and future expenses—here’s what to track in 2025.

Financial Impacts

- Lower On-Road Price: Subsidies decrease your total loan needed, so lower interest paid over time.

- Faster Loan Repayment: Some state schemes reduce EMI by as much as ₹1,000-₹2,000/month.

Tax Benefits

- Section 80EEB Deduction:

- Up to ₹1.5 lakh exemption on interest paid for EV loans, allowed yearly until repayment or ₹1.5 lakh limit is met.

- No Road Tax/Registration Charges:

- In top states, you pay nothing or only a nominal fee.

- Depreciation (Commercial Buyers):

- Up to 40% depreciation allowed for EVs in business fleets (FY 2024-25, as per Income Tax norms).

Tax Filing

- Get loan statements and interest certificates from your lender.

- Mention loan interest in your ITR under ‘Deductions’ (section 80EEB).

Final Verdict: Should You Apply for an EV Loan Subsidy Now?

If you want to reduce your total cost of owning an electric vehicle in India, 2025 is a golden year to move forward. Here’s why you should act:

- Central and state subsidies are at their most generous, with future reductions likely after March 2025.

- Banks and NBFCs are actively competing, bringing down interest rates and offering specialized EV products.

- Tax benefits offset upfront investment, and eco-friendly driving means long-term savings on fuel and maintenance.

- Manufacturers and dealers have streamlined the process; most of your subsidy comes as an upfront cash deduction.

- Digital application portals and quick approvals make the process smoother than ever.

- Your EV purchase not only benefits you and your family but also supports India’s green, sustainable future!

Recommended: Apply before policy changes post-March 2025. Compare state and central offers, pick eligible models and trusted lenders, and prepare for a hassle-free, financially savvy switch to electric mobility.

Disclaimer: Subsidy amounts, interest rates, tax rules, and eligibility criteria are subject to change as per government notifications. Always check official portals or contact your lender/dealer for the most updated information before making a purchase or application.

FAQs

Q1. Can I claim both state and central (FAME II) subsidies together in 2025?

Yes, in most states you can combine state and FAME II subsidies, subject to eligibility and capped amounts.

Q2. Is a CIBIL score important for EV loan approval?

Yes, a good CIBIL score (650+) increases your EV loan approval chances and helps in getting better rates.

Q3. Do NRIs qualify for Indian EV subsidies?

No, only resident Indian citizens and registered Indian entities can apply. NRIs are not eligible as of 2025.

Q4. Are electric vehicle subsidies taxable?

No, subsidies are not treated as taxable income. But do check current tax laws, as they can change.

Q5. Can I sell my EV immediately after getting the subsidy?

No, most schemes require you to retain the vehicle for a minimum period (typically 1-2 years) or you may have to return the subsidy.

Have more questions about EVs in India or the application process? Drop your query on the official FAME India Portal or visit your nearest certified EV dealer for personalized support!