Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

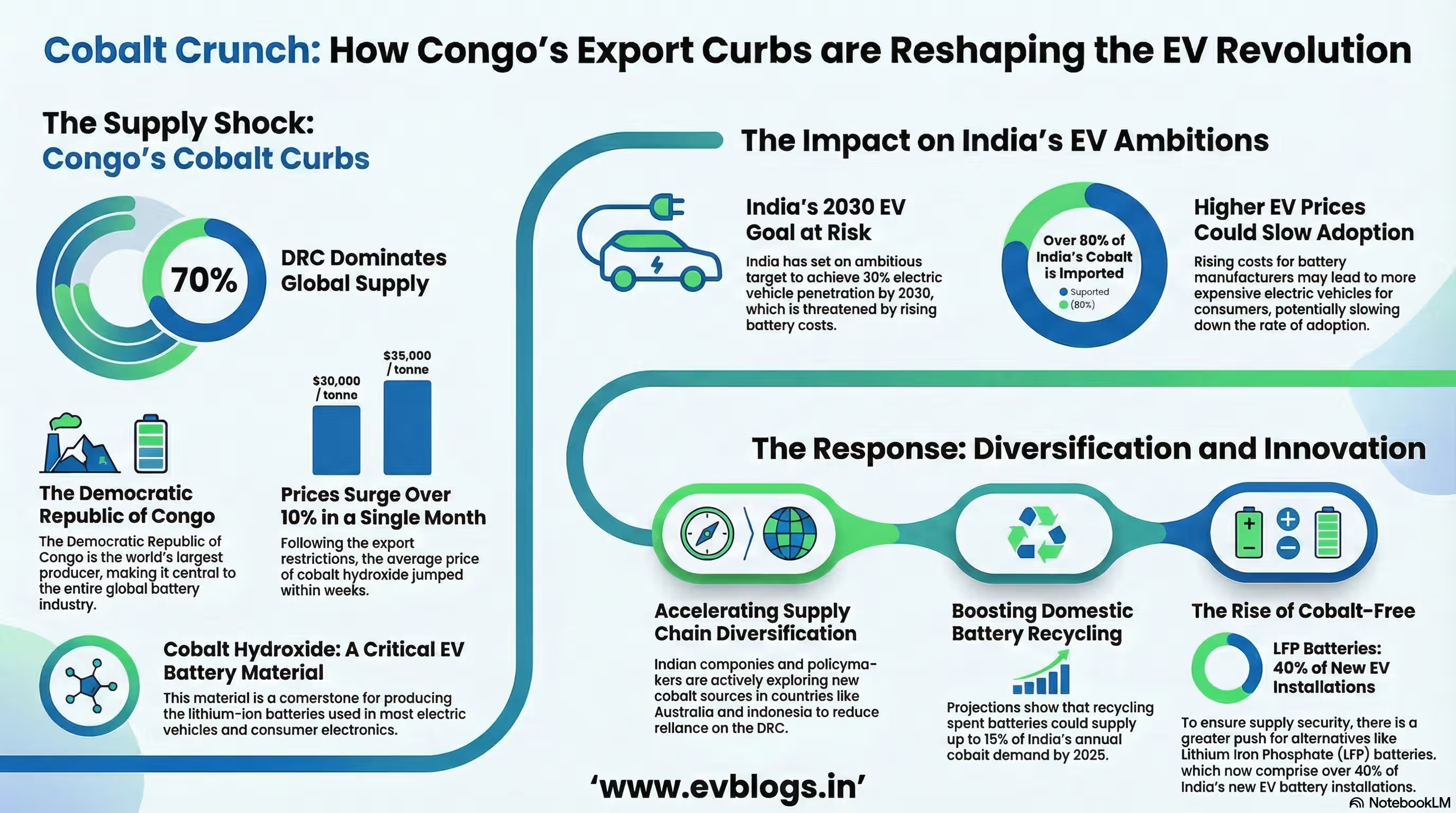

NEW DELHI, Dec 9 — Cobalt hydroxide, a critical material for electric vehicle (EV) batteries, has seen a sharp rise in prices following export restrictions imposed by the Democratic Republic of Congo (DRC), the world’s largest cobalt producer. This development is set to have significant implications for global supply chains and India’s rapidly growing EV sector. Below, we examine the key factors driving this price surge and its impact.

1. Congo’s Export Curbs Restrict Global Supply

The Democratic Republic of Congo accounts for nearly 70% of the world’s cobalt supply, making it central to the global battery industry. Recently announced export curbs have limited shipments of cobalt hydroxide, tightening international supply.

“Congo’s export restrictions have removed a significant volume of cobalt from the global market, pushing up prices by over 10% in the past month.”

This policy shift is aimed at increasing local value addition but has immediate repercussions for downstream industries worldwide.

2. Rising Costs for Battery Manufacturers

Battery-grade cobalt hydroxide is a cornerstone of lithium-ion battery production, used extensively in EVs, smartphones, and energy storage solutions. With prices jumping sharply, battery manufacturers in India and abroad are facing higher input costs.

According to industry analysts, “the average price of cobalt hydroxide has surged from $30,000 to $35,000 per tonne within weeks, straining margins for battery makers.”

This could potentially slow the pace of battery price reductions, a key factor in making EVs more affordable for Indian consumers.

3. Impact on India’s Electric Vehicle Ambitions

India has set ambitious targets to electrify its transport sector, with a goal to achieve 30% electric vehicle penetration by 2030. The country relies heavily on imported cobalt, particularly from African nations like Congo.

“India’s EV transition is vulnerable to global cobalt supply shocks, as over 80% of its battery-grade cobalt is imported,” notes an industry expert.

Rising cobalt costs may lead to increased prices for electric vehicles, potentially impacting adoption rates and the government’s clean mobility goals.

4. Supply Chain Diversification Efforts Accelerate

In response to such disruptions, Indian companies and policymakers are seeking ways to diversify supply chains. This includes exploring new sources in Australia, Indonesia, and recycling initiatives domestically to reduce dependence on Congo.

“Recycling spent batteries could supply up to 15% of India’s annual cobalt demand by 2025,” according to projections by the Council on Energy, Environment and Water.

These efforts are crucial for building resilience in India’s EV ecosystem.

5. Push for Cobalt Alternatives and Battery Innovation

The latest price surge is also encouraging greater research into cobalt-free or low-cobalt battery chemistries. Indian institutions and start-ups are working on alternatives such as lithium iron phosphate (LFP) batteries, which are less reliant on cobalt.

“LFP batteries now comprise over 40% of India’s new EV battery installations, driven by cost and supply security concerns,” industry data shows.

Such innovations could help reduce India’s vulnerability to global cobalt market swings in the long term.

6. Global Market Volatility and Investor Sentiment

The volatility in cobalt prices has led to heightened uncertainty for investors across the battery and EV supply chain. Companies are re-evaluating sourcing strategies and contracts, while governments may intervene to stabilise markets.

“Market volatility has increased risk premiums for battery projects, affecting financing and expansion plans in India and beyond,” notes a Mumbai-based investment manager.

Managing these risks will be essential for sustaining growth in the EV sector.

, Congo’s export curbs have sent ripples through the global cobalt market, driving up prices and posing significant challenges for India’s electric mobility transition. As the country works to secure its supply chains and promote innovation, the coming months will be crucial in determining the pace and cost of India’s EV revolution.

Sources

Original Source

google.com - Read original

Official Sources

- Intergovernmental Panel on Climate Change (IPCC): IPCC opens registration of experts to review the first draft of the Methodology Report on Inventories for Short-lived Climate Forcers

Quotes

- Publishing Domain: google.com

- Published Date: 2025-12-09T18:51:17+05:30

- Original URL: Read original (news.google.com/rss/articles/CBMivwFBVV95cUxOUU5WNk1McUZka3NCdmNfcnJiSGVyR… …)

Editorial Check

- Originality: 45 / 100 — The summary is mostly a restatement of the article title and does not add significant new information or unique phrasing. It closely mirrors the source headline.

- Helpfulness: 30 / 100 — The summary provides minimal context and does not elaborate on the reasons, implications, or details of the export restrictions or their impact. Readers gain little additional understanding beyond the headline.