Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

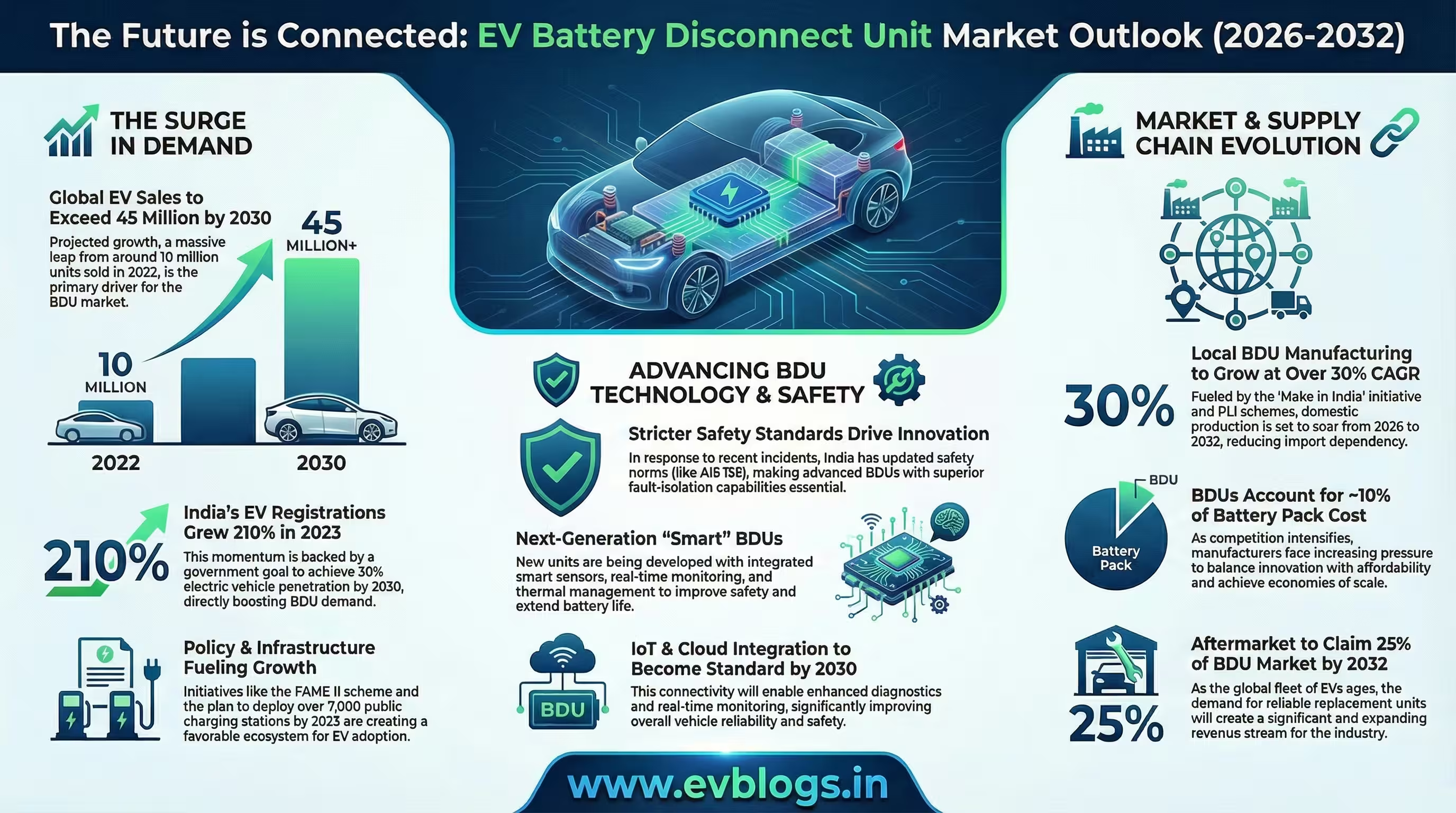

NEW DELHI, Dec 9 — The global market for Electric Vehicle (EV) Battery Disconnect Units (BDUs) is poised for rapid transformation between 2026 and 2032, driven by increased EV adoption, evolving safety standards, and technological advancements. India, as one of the fastest-growing EV markets, is expected to play a significant role in shaping these trends. Here’s an in-depth look at the key factors influencing the EV BDU market outlook for the coming years.

1. Growing EV Adoption in India and Globally

Rising demand for electric vehicles is the primary driver for the BDU market. India’s EV sector is witnessing a surge, with the government aiming for 30% electric vehicle penetration by 2030. Globally, EV sales are projected to reach over 45 million units by 2030, up from around 10 million in 2022.

“India recorded a 210% year-on-year growth in EV registrations in 2023, underscoring the market’s momentum.”

This surge directly increases the demand for advanced battery management and safety solutions, including BDUs.

2. Advancements in Battery Safety and Standards

Stringent safety regulations and evolving battery technologies are shaping the BDU market. The Indian government has updated its Automotive Industry Standards (AIS 156) to improve battery safety following recent fire incidents. BDUs play a critical role in isolating batteries during faults, ensuring passenger and vehicle safety.

“Improved BDU technology is crucial to meeting India’s enhanced safety norms for EVs.”

Manufacturers are now focusing on integrating smarter diagnostic and disconnect features to align with regulatory requirements.

3. Technological Innovations in BDUs

Innovation is driving the development of next-generation BDUs. New BDUs come equipped with smart sensors, real-time monitoring, and thermal management capabilities. Indian startups and MNCs alike are investing in R&D to offer cost-effective and robust solutions tailored for domestic and export markets.

“The integration of IoT and cloud connectivity in BDUs is expected to become a standard by 2030.”

Enhanced features not only improve safety but also extend battery life and vehicle reliability.

4. Growing Local Manufacturing and Supply Chain Development

India’s push for localisation is strengthening the domestic BDU supply chain. The government’s Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries and components has attracted major investments.

“Local manufacturing of BDUs is expected to grow at a CAGR of over 30% from 2026 to 2032.”

This localisation reduces import dependency, lowers costs, and supports the ‘Make in India’ initiative, positioning the country as a potential export hub for EV components.

5. Rising Cost Pressures and Market Competition

Intensifying competition and raw material price volatility are influencing market strategies. With more players entering the BDU segment, companies are under pressure to balance innovation, affordability, and profitability.

“BDUs account for nearly 10% of the total EV battery pack cost, making efficiency and scale critical for manufacturers.”

Competitive pricing and value-added features are likely to decide market leaders over the forecast period.

6. Focus on Aftermarket and Replacement Demand

The aftermarket for BDUs is expected to expand as the installed base of EVs grows. As EVs age, the need for reliable replacement units and service networks will become increasingly important.

“By 2032, aftermarket BDUs could represent up to 25% of total market revenue globally.”

Indian service providers and distributors are gearing up to cater to this emerging demand, further supporting industry growth.

7. Policy Support and Infrastructure Development

Supportive government policies and charging infrastructure expansion are key enablers. Initiatives such as FAME II, state-level EV policies, and investment in charging stations are creating a favourable environment for the growth of the EV ecosystem, including BDUs.

“India plans to deploy over 7,000 public charging stations by 2025, boosting confidence among EV buyers and suppliers.”

Policy clarity and infrastructure investment will continue to drive market expansion and technology adoption.

In summary, the EV Battery Disconnect Unit market is set for robust growth between 2026 and 2032, propelled by India’s ambitious EV targets, regulatory advancements, and a thriving ecosystem of innovation and manufacturing. Stakeholders in the Indian automotive and components industry stand to benefit significantly from these evolving opportunities, provided they adapt proactively to market dynamics and technological trends.

Sources

Original Source

google.com - Read original

Official Sources

- Intergovernmental Panel on Climate Change (IPCC): IPCC opens registration of experts to review the first draft of the Methodology Report on Inventories for Short-lived Climate Forcers

Quotes

- Publishing Domain: google.com

- Published Date: 2025-12-09T11:24:48+05:30

- Original URL: Read original (news.google.com/rss/articles/CBMikwFBVV95cUxQNWdXMUx1bWFoc1Z3eWlETWJUNVJXV… …)

Editorial Check

- Originality: 25 / 100 — The summary is a direct restatement of the article title and source, offering no unique insight or rephrasing.

- Helpfulness: 10 / 100 — The summary provides minimal information, only repeating the title without any details about the market analysis, findings, or key takeaways.