Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

NEW DELHI, Jan 2 — The United States’ push for battery independence is poised to bring significant changes to the global electric vehicle (EV) industry. This shift, driven by advances in technology, supply chain localisation, and policy initiatives, will have ripple effects worldwide, including in India. As the world’s third-largest automobile market, India stands to witness both challenges and opportunities as US battery autonomy transforms the EV landscape.

1. Shift in Global Supply Chains

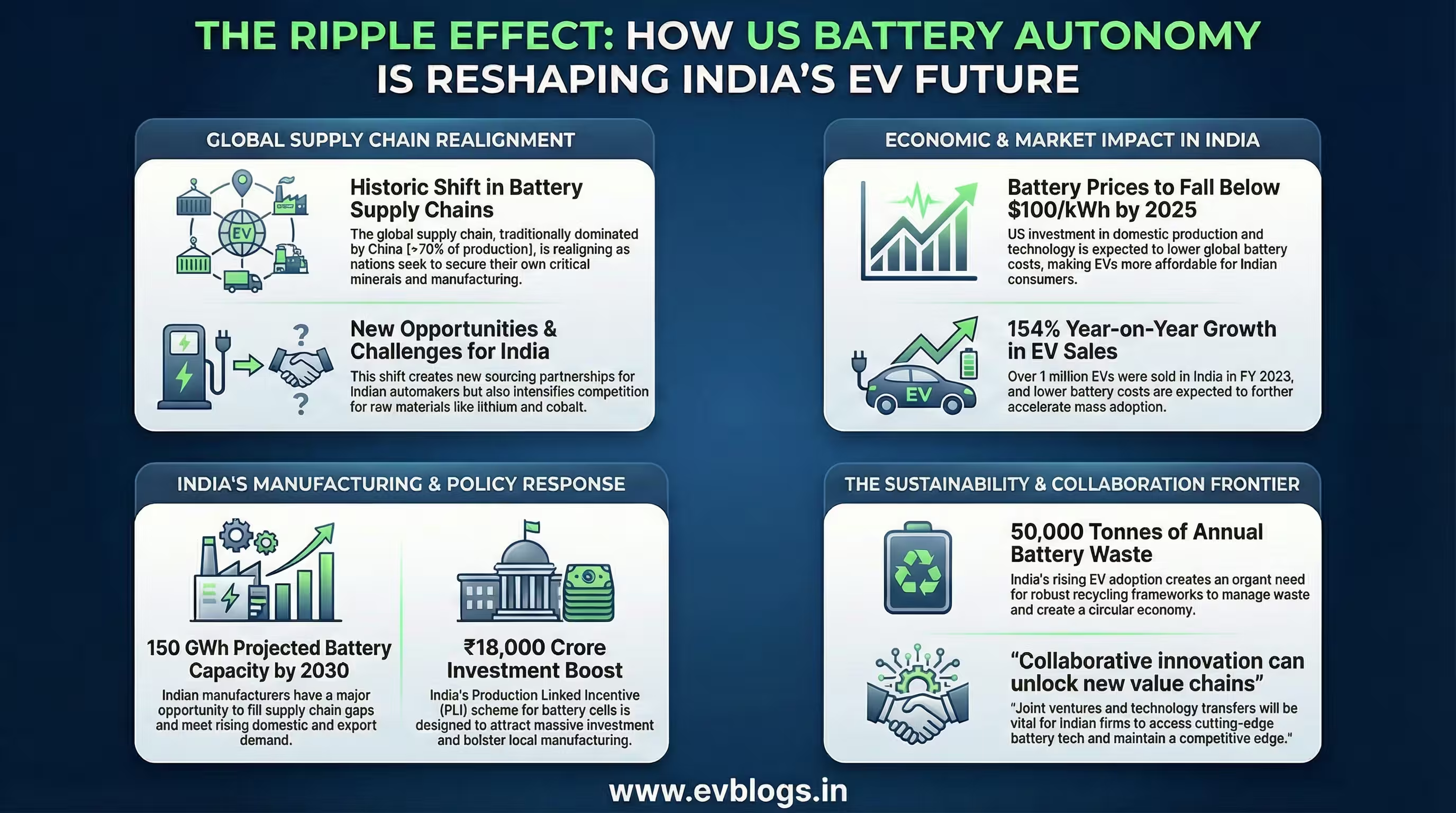

The US move towards battery self-sufficiency is expected to realign international supply chains. Traditionally, battery manufacturing has been dominated by East Asian countries, especially China, which controls over 70% of the global lithium-ion battery production.

“The global battery supply chain is undergoing a historic realignment as nations seek to secure critical minerals and manufacturing capacity.”

For Indian automakers and suppliers, this could mean new sourcing opportunities and partnerships, but also increased competition for raw materials like lithium and cobalt.

2. Impact on Battery Prices

With the US investing heavily in domestic battery production and raw material extraction, battery costs are projected to decrease due to technological advancements and economies of scale. This could have a cascading effect on global prices, making EVs more affordable for Indian consumers.

According to industry estimates, battery pack prices could fall below $100 per kWh by 2025, a critical threshold for mass EV adoption.

Lower battery costs would bolster India’s own EV goals, supporting both passenger and commercial vehicle segments.

3. Opportunities for Indian Manufacturers

As US and European companies seek to diversify their supply chains away from China, Indian battery and component manufacturers may find new export opportunities. Firms with expertise in cell manufacturing, battery management systems, and recycling could benefit from increased demand.

“India’s battery manufacturing capacity is projected to reach 150 GWh by 2030, driven by both domestic and export demand.”

Encouraging investment in R&D and building partnerships with global players will be key for Indian firms to capitalise on this shift.

4. Policy Implications for India

The US government’s focus on battery autonomy—supported by incentives and strategic reserves—signals the need for strong policy support in India. The Indian government has already rolled out schemes like the Production Linked Incentive (PLI) for Advanced Chemistry Cell (ACC) batteries.

“PLI schemes are expected to attract investments of over ₹18,000 crore in India’s battery sector.”

To remain competitive, India may need to enhance its policy framework, secure critical mineral supplies, and invest in localised research and talent development.

5. Acceleration of EV Adoption

A more stable and diversified battery supply ecosystem will likely accelerate global EV adoption, including in India. Affordable batteries are essential for lowering the total cost of ownership and overcoming range anxiety—key barriers for Indian consumers.

Over 1 million electric vehicles were sold in India in FY 2023, marking a 154% year-on-year growth.

With improved access to advanced batteries, Indian automakers can offer better-performing vehicles, thus driving greater acceptance among both urban and rural consumers.

6. Focus on Sustainability and Recycling

Battery independence is not just about manufacturing; it also involves sustainable sourcing and end-of-life management. The US and other leading markets are investing in battery recycling technologies to reduce dependency on virgin raw materials.

“India generates about 50,000 tonnes of lithium-ion battery waste annually, a number set to rise sharply with EV growth.”

Developing robust recycling frameworks and circular economy models will be crucial for India to manage environmental impacts and support long-term industry growth.

7. Strategic Collaboration and Competition

The changing landscape will foster both collaboration and competition among global and Indian players. Joint ventures, technology transfer agreements, and cross-border R&D will be vital for accessing cutting-edge battery technologies and maintaining competitiveness.

“Collaborative innovation can unlock new value chains and speed up the deployment of next-generation battery technologies.”

Indian stakeholders must proactively engage with global partners while building indigenous capabilities to thrive in the new EV hierarchy.

, the US drive for battery independence is set to reshape the electric vehicle industry’s global order. For India, this presents an opportunity to strengthen its own EV ecosystem, boost local manufacturing, and secure a competitive position in the emerging green mobility era. Strategic planning, policy alignment, and international collaboration will be essential for India to capitalise on these transformative changes.

Sources

Original Source

google.com - Read original

Official Sources

- Intergovernmental Panel on Climate Change (IPCC): IPCC opens registration of experts to review the first draft of the Methodology Report on Inventories for Short-lived Climate Forcers

Quotes

- Publishing Domain: google.com

- Published Date: 2026-01-02T12:30:00+05:30

- Original URL: Read original (news.google.com/rss/articles/CBMipwFBVV95cUxPTHpfMXZVVlVsQUI1cTExOUwxVGx4W… …)

Editorial Check

- Originality: 65 / 100 — The article addresses a timely and important topic—the impact of US battery autonomy on the electric vehicle (EV) industry hierarchy. While the subject is widely discussed in industry circles, the analysis may offer fresh perspectives or unique data, but the general theme is not entirely novel.

- Helpfulness: 80 / 100 — The article is likely helpful for readers seeking to understand current shifts in the EV market, especially regarding US policy and supply chain developments. It provides context and analysis that can inform business or investment decisions, though it may not delve deeply into technical details.