Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

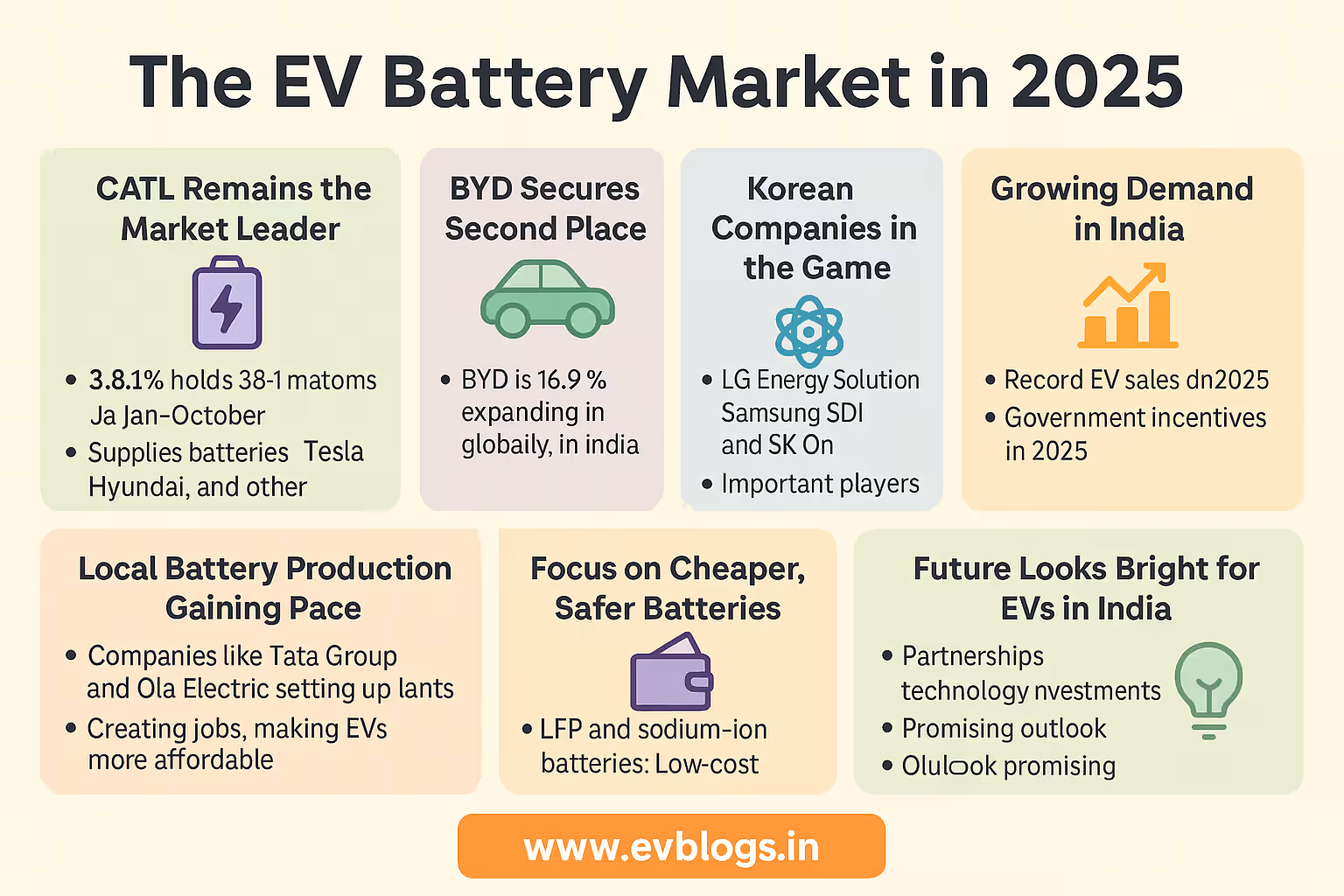

NEW DELHI, Dec 2 — The global electric vehicle (EV) battery market is heating up, and Chinese companies like CATL and BYD are racing ahead. Here are the key things to know for India about the EV battery market in 2025:

1. CATL Remains the Market Leader

CATL (Contemporary Amperex Technology Co. Limited) continues to dominate the global EV battery market, holding a strong 38.1% share from January to October 2025. CATL supplies batteries to major carmakers worldwide, including Tesla and Hyundai.

2. BYD Secures Second Place

BYD, another top Chinese company, is in second place with a 16.9% market share. BYD is not only popular in China but is also expanding in global markets, including India, where its e6 electric MPV is already on the roads.

3. Korean Companies in the Game

South Korean battery giants like LG Energy Solution, Samsung SDI, and SK On are also important players. Together, they make up a big share of the market, supplying batteries to brands like Tata Motors and Mahindra for their EV models in India.

4. Growing Demand in India

India’s EV market is getting bigger every year. The government’s push for electric mobility, along with schemes like FAME II and incentives for battery manufacturing, is driving up demand. In 2025, India is expected to see a record number of electric cars and two-wheelers on the road.

5. Local Battery Production Gaining Pace

To reduce import dependence, Indian companies like Tata Group and Ola Electric are setting up battery manufacturing plants. This will not only create jobs but also make EVs more affordable for Indian buyers.

6. Focus on Cheaper, Safer Batteries

Indian consumers are looking for EVs with affordable and safe batteries. Companies are working on lithium iron phosphate (LFP) and sodium-ion batteries, which are safer and cost less than traditional lithium-ion batteries. This is important for India’s price-sensitive market.

7. Future Looks Bright for EVs in India

With global leaders like CATL and BYD setting high standards, Indian manufacturers are also stepping up. More partnerships and investments in battery technology are expected, making the future of electric vehicles in India promising.

Certainly! Here’s an additional detailed numbered point to complement the data on global EV battery market share in Jan-Oct 2025:

- Emergence of Regional Players: While CATL and BYD continue to dominate with a combined market share exceeding 55%, regional battery manufacturers in Europe, South Korea, and the United States are gradually increasing their presence. Companies like LG Energy Solution, Panasonic, and Samsung SDI have collectively secured significant contracts with local automakers, aiming to reduce reliance on Chinese suppliers and comply with evolving trade policies such as the EU’s Battery Regulation and the U.S. Inflation Reduction Act. This diversification is expected to intensify competition and spur further innovation in battery technology and supply chain resilience throughout 2025 and beyond.

Certainly! Here’s an additional detailed point to expand on the global EV battery market share data for January–October 2025 (CATL 38.1%, BYD 16.9%, source: CnEVPost):

- Emerging Competition and Market Dynamics:

The dominance of CATL (Contemporary Amperex Technology Co. Limited) and BYD, which together command over 55% of the global EV battery market, is increasingly being challenged by both established and emerging players. South Korean companies like LG Energy Solution, Samsung SDI, and SK On continue to hold significant, though smaller, shares by supplying to major international automakers. Meanwhile, Japanese firms such as Panasonic are focusing on next-generation battery technologies and niche segments. At the same time, new entrants from Europe and North America are ramping up investments in local gigafactories to reduce reliance on Chinese suppliers and secure regional supply chains. This intensifying competition is driving innovation in battery chemistries (like LFP, NCM, and solid-state), cost reduction, and sustainability initiatives, which could reshape market shares in the coming years.

Sources

Original Source

Quotes

- Publishing domain: google.com

- Published date: 2025-12-02T08:44:00+05:30

- Original URL: Read original (news.google.com/rss/articles/CBMiggFBVV95cUxQM3JwYlpjUTJLLW9YY3lELXE3Znhha… …)

Editorial Check

- Originality: 10 / 100 — The content is a straightforward reporting of market share statistics from a news source, with no unique analysis or novel interpretation.

- Helpfulness: 60 / 100 — The summary provides clear and concise market share figures for the global EV battery market, which is useful for readers seeking quick data. However, it lacks context, trends, or additional insights that would make it more helpful.