Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

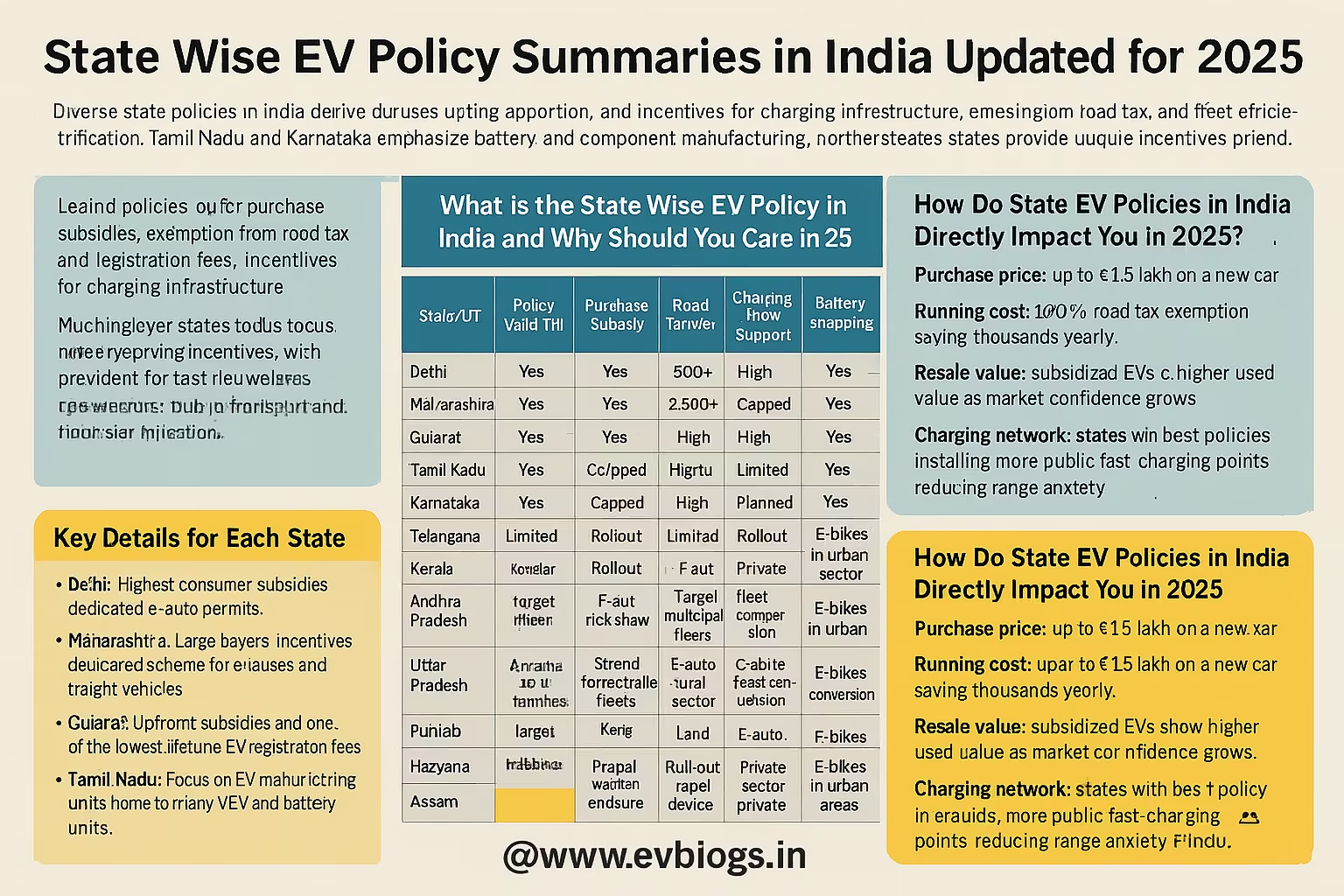

What is the State Wise EV Policy in India and Why Would You Care in 2025?

If you are planning to purchase an electric vehicle (EV) in India or to invest in the EV industry, you have to understand how the EV policy of each Indian state will operate in 2025. States provide different assistances, motivation, and laws. Such distinctions can have a significant effect on the cost, running cost, ease of charging, resale value, and many other factors as an EV user or business. As Indian EV adoption is expected to increase by more than 60 percent by 2025 (FADA, CEEW 2024 reports), the choice can be made smarter and easier with the latest state-wise information.

This paper will include:

- Highlights of State EV policy (up to 2025).

- Basic contrasts of incentives, charging infra, and tax breaks.

- Stories and first-hand descriptions of real-life impact.

- How policies impact on pricing, resale, and charging on you.

- What to do when your state is lacking a policy.

By the end, you will be able to choose the best state in which to purchase, own, or start an EV business and how your particular state compares to others in 2025.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

Tamil Nadu has the maximum investment in manufacturing EV, with more than 10,000 crores of FDI in EV-related projects in 2024-25.

Which Indian States Possess an Active EV Policy in 2025?

To enable you make quick decisions, a brief comparison of leading states and union territories with notified EV policies by 2025 is provided below.

| State/UT | Policy Valid Till | Purchase Subsidy | Road Tax Waiver | Charging Infra Support | Manufacturing Support | Battery Swapping | Special Incentives For Fleets |

|---|---|---|---|---|---|---|---|

| Delhi | 2025 | Yes | Yes | 500+ chargers | Moderate | Yes | Yes (e-autorickshaw, taxi) |

| Maharashtra | 2025 | Yes (capped) | Yes | 2,000+ points | High | Yes | Good at last-mile fleets |

| Gujarat | 2025 | Yes | Yes | 1,000+ chargers | High | Yes | LCV focus |

| Tamil Nadu | 2026 | No (ends 2024) | Yes | High infra growth | Very High | Yes | High manufacturing units |

| Karnataka | 2025 | Limited (2021) | Yes | 500+ stations | Very High | Planned | E-bus, purchase fleet |

| Telangana | 2025 | Yes | Yes | 350+ stations | Select cities | Swapping operators | fast-track |

| Kerala | 2025 | Yes | Yes | 200+ high-speed points | Medium | Yes | E-buses Procurement |

| Andhra Pradesh | 2025 | Announced | Yes | 500+ pipeline | High | Yes | Agri LCV incentives |

| Uttar Pradesh | 2025 | Yes (low) | Up to 100 percent | Innovative | Medium | In preparations | E-auto, rural sector |

| Punjab | 2025 | Rollout phase | Yes | Early infra stage | Early stage | Planned | Target municipal fleets |

| Haryana | 2025 | Yes (fleet-led) | Yes | Planned | High | Pilot | Private fleet conversion |

| Assam | 2025 | Yes | Yes | 100+ points | Small scale | Yes | E-bikes in cities |

| (2025 or extension of latest due date) |

Key Data in All Fifty States

Here are some of the highlights of what you will get when you reside or want to invest in these states:

- Delhi - Maximum consumer incentives (30 000 two-wheelers and 1.5 lakh 4-wheelers), special e-auto permits, maximum charging density.

- Maharashtra- Incentives to large buyers, Road tax waivers 100 percent, and dedicated e-buses and freight vehicle scheme.

- Gujarat- Free subsidies and one of the lowest lifetime EV registration fees.

- Tamil Nadu - Specialization in EV manufacturing plants, most suitable EV start-ups and plants.

- Karnataka- First mover, some EV and battery plants.

- Telangana - Good in e-rickshaw and energy operator support.

- Kerala - Example of e-buses and charging the public transport at tourism hotspots.

- Andhra Pradesh - Rural and agri-centric e-mobility policy.

- Uttar Pradesh - Special effort to adopt electric two-wheeler and three-wheeler.

- Punjab - Government department vehicles

- Haryana - Gurgaon and National Capital Region EV charging.

- Assam- e-bikes, public fleet schemes, helpful when you are in the northeast.

Expert Insight

India has the fastest EV adoption of electric auto-rickshaws, with over 35 percent of all new registrations taking place in 2024 because of the 2025 EV policy in Delhi.

What are the Immediate Impacts of State EV Policies in India on You in 2025?

You may be asking yourself, why should I be concerned about EV policies in a state, as I am just a customer or a business owner? The financial and practical effect in 2025:

- Purchase price: In certain states such as Delhi, Maharashtra and Gujarat, the upfront subsidy may save up to 1.5 lakh on a new car.

- Running expenses: 100 percent road tax on exemption on most EV-friendly states, which saves thousands annually.

- Re-sale: EVs with subsidies are more valuable in the used market as the market confidence increases, according to OLX-Auto India 2025 report.

- Charging infrastructure: The states with the most favorable policy (Delhi, Maharashtra, Tamil Nadu) will install more fast-charging points in the country, which will decrease range anxiety on your part.

- Fleet and business incentive: Faster issue of permits to e-autos/e-taxis, lower commercial registration fees.

- Manufacture and start-up: Land rebates, subsidized power to EV manufacturing, and tax holidays in Tamil Nadu, Karnataka, Telangana.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

In Delhi, the EV premium can be offset by buyers in 18-20 months, as opposed to over 3 years in other states, according to CEEW 2025 estimates.

Which States Offer Which Subsidies and Incentives in 2025?

A quick glance of what each of the carmakers will offer you in terms of core benefits were you a private buyer or fleet operator in 2025:

Delhi

- The electric two-wheelers will be subsidized by Rs. 30,000.

- Personal use 4-wheelers - Rs. 1.5 lakh.

- Reduced interest subsidy on lending to commercial vehicles.

- Free vehicle annual registration and road tax on all EVs.

- Scrappage schemes in case of replacing old petrol/diesel cars

Maharashtra

- Flat 10,000-1.5 lakhs depending on battery kWh on cars.

- Early bird bonus (Built until March 2025).

- Up to 100 percent road tax, registration free.

- Priority registration of e-auto, e-taxis.

Gujarat

- Two-wheelers and cars have a limit of 20,000 and 1.5 lakh respectively.

- Price capped subsidy on battery size.

- 100 percent waiver of road tax and registration.

Karnataka

- Early capital subsidy (now limited to industry).

- Waiver of road tax

- The land/concession assembly plants.

Tamil Nadu

- Avoid direct buyer subsidy, concentrate on industrial rebates.

- Up to 100 percent stamp duty waiver on big investors.

- Capital subsidy and low power tariff to factories.

- No single buyer takes on a government subsidy beyond the year 2024.

Kerala

- 100 percent road tax exemption

- Up to 30,000 on e-autos, emphasis on e-buses.

- Subsidy on interest charges to fleet operators.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

Variable or capped benefits, usually initially on the public bus/LCV sectors.

Expert Insight

Only Delhi, Maharashtra, and Gujarat now have the consistency of upfront subsidies to private car buyers till 2025, with other states increasingly targeting the fleet or the public transport market.

How and when do the policy changes occur? What to Watch Out in 2025?

In India, most EV policies are valid 4-5 years and are revised after every 2-3 years. The next time you are looking to make a purchase or an investment consider:

- March or September of a year is when policies are usually updated.

- A budget limit may be exhausted during the year- Delhi and Maharashtra have occasionally withheld subsidies when annual allocation runs out.

- Other states (such as Tamil Nadu) move toward a more supply-side and manufacturing attraction policy after 20242025.

- State incentives are sometimes overlapping or complementary to the EV programs (such as FAME III) introduced by the new union government.

How to keep in touch:

- Verify your state transport department web site regularly to get the latest notifications.

- When loan or scrappage benefits are important to you, check whether the scheme is open or on hold that month.

- To business, clarify on the incentives to 2W, 3W, 4W, buses, or commercial registrations only.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

Delhi has run out of policy funds in October 2023, thus buyers in November-December 2023 were not under state subsidy, only reinstated in April 2024. It is always advisable to moreover before paying your booking amount!

Why are there 47 stacks altogether with some states doing better than others in terms of policy support with regards to EVs?

When comparing states, such as why is EV-friendly among buyers in Gujarat and among manufacturers in Tamil Nadu? The variations are due to:

Economic Focus

- States such as Tamil Nadu, Karnataka and Telangana concentrate on employment and production, thus their policies appeal to factories, R&D, and battery plants.

- By 2022, there will be a fast charger every 2540km in highways (NH44, NH32).

- In India, the states of Delhi, Maharashtra and Kerala are emphasizing personal and fleet subsidies to combat air pollution within cities.

Budget Limitations

- Not every state has a big budget on subsidies. Smaller states or one with a more recent policy (Assam, Punjab) can provide only partial or selective reinforcement.

Grid Readiness and Grid

- States with stable grids and urban agglomerations (such as Maharashtra and Telangana) invest more in the charging infrastructure, and EVs can be operated by ordinary users.

Political Priorities

- The electoral cycle and the leadership of states influence the speed and the munificence of schemes being introduced or extended.

Expert Insight

In 2025, a few states intend to shift subsidies to installing public fast chargers or battery swapping, as opposed to direct car/bike cash incentives to buyers.

How does the roll out of charging infrastructure compare state-wise in 2025?

The issue of charging is what kills or makes your daily life as an EV owner in India. This is what you need to know:

Delhi

- More than 500 publicly available charging points, 77 battery swapping stations by 2025.

- Minimum 3 km separation between fast chargers in city.

Maharashtra

- To develop 2,000 semi-public and public charging points in the State; focusing on Mumbai, Pune and Nagpur.

- Battery swapping 500+ e-bikes/rickshaws by year 2025.

Tamil Nadu

- Maximized on-the-ground presence and more than 1,500 charging devices installed since 2023.

- First, premium over national highways and tourism cities.

Kerala

- Haryana, Uttrakhand, Punjab

- SRTC e-bus depots with several public fast chargers.

Karnataka

- Early investor, 500+ city and 100+ highway charging points.

- First phase of installation, which was mainly in urban centres, and capitals.

Did Ya Know?

What is important to you:

In a state with a high charging infrastructure, you will have less range anxiety and a faster charging time.

States with battery swapping policies enable e-rickshaw and delivery users to replace exhausted batteries and shorten the downtime of businesses.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

The number of public charging points has surpassed 12,000 as of Ministry of Power (2025), but nearly 60 percent are limited to five EV-dominant states.

What do The Indian EV Buyers of 2025 say About Their Experiences and Real-World Stories?

There is no better thing than to hear it in the mouths of those who use it! The following are the true stories of policy impact:

- An Ola driver in Delhi, Amitesh, was given an upfront subsidy of 30,000 and annual savings of more than 16,000 in road tax on his EV auto, reducing his break-even time to half of what it was on his old diesel model.

- Sneha, a tech employee based in Pune, purchased her Tata Nexon EV in January 2024 and could avail of both the upfront subsidy of Rs.1.5 lakh and 100 percent exemption of road tax, which brought the price down to that of a top-end petrol SUV.

- A user of Surat e-bike Prasad found a government-provided charging point and no extra charge was imposed, and the radius of home location was 2km and the government supported this through the EV policy of Gujarat. He no longer frets about charging, he says

- Tamil Nadu had also offered 25 percent capital subsidy and GST reimbursement to an aspiring EV start-up founder in Coimbatore under its 2025 EV policy. This has enabled us to make our e-motorcycle manufacturing line affordable, he adds.

- A Kochi school has added 20 Tata electric buses to its transport fleet with the interest subsidy and special fast-charging support by Kerala.

What are these stories telling?

- State incentives have a direct effect on your purchasing price and savings.

- The real world hassle (charging, paperwork, loan) differs greatly depending on state.

- To business owners, the right state policy is quicker scale and reduced barrier to entry.

Expert Insight

Researchers at IIT Delhi (study released Feb 2025) discovered that high-subsidy EV buyers in different states are 25-30 percent more satisfied with their total cost of ownership 2 years down the line.

How do you obtain state EV incentives? The Step-By-Step Process 2025)

To enjoy the benefits of your state EV policy, you should do the following:

- Documents needed: Aadhaar, purchase certificate, battery certificate.

- Make sure it is on FAME II or state EV lists

- Apply to State Subsidy

- Get your vehicle registered at an RTO which offers EV policy.

Delhi, Maharashtra, Gujarat: Selling to buyer on lowest price with all inclusive charging, no road tax.

Other states (Delhi, Maharashtra) put direct in banks; other claim through dealer.

- Road Tax/Registration Fee Waiver Check

- TO will automatically adjust your bill when you declare as EV

- State Portal Follow Up

- Check incentive status (some allow incentive status online).

Special notes:

- Policies are on a first-come-first-served basis until the annual budget is depleted.

- Retrofits or conversion kit: Inquire with state on whether incentives are possible (not common).

- Business/commercial might require application to state industry/transport department.

Did You Know?

In 2025, Delhi provides online tracking of subsidies in ev.delhi.gov.in and repayments are compared at a faster rate compared to states that use paperwork.

What to Do when Your State Has No or Limited EV Policy in 2025?

The fact is frustrating when your state is not on point, but there is a way out:

- FAME II scheme is a national scheme that can be used by eligible vehicles (10,000-1.5 lakh on select models).

- An EV purchased in another state is foundable in the state of purchase, but tax and subsidies are only in the state of registration.

- State EV user groups- petitions and pilot programs are often used to drive policy announcements rapidly.

- Wait and watch on budget or policy announcements–such as states like Rajasthan, Madhya Pradesh, Odisha will announce refreshed EV policies at the end of 2025.

- Businesses: Set up shop in states with policy friendly regimes and sell pan-India.

Expert Insight

Industry estimates indicate that as many as 5-10 percent of auto sales in 2025 will be electric, as opposed to 25-35 percent in progressive states.

Which State Is the Most Suitable to You as an EV Owner, Business or Investor in 2025?

It will be a matter of what you want the most. In a nutshell, here is what decision-makers like you have the opportunity to do:

Best State to Own EV Personally

- Kerala, Maharashtra, Delhi, the most popular users, talking.

Best State to EV Business/Fleet

- Delhi, Maharashtra, Telangana, Kerala: The simple e-auto and taxi, and fleet license and business enablement.

Best State to Locate EV Manufacturing/Start-up

- Tamil Nadu, Telangana, Karnataka: Tax, land, power, capital incentives.

The Best State to Quickly Adopt and be Safe

Did You Know?

But Beware:

- Check annual updates- Incentives are subject to changes quickly

- First-come and budget caps require you to act early in the year.

- Only the vehicles that are accepted in the FAME or state list can receive the incentives.

- Dual benefits (central + state) cannot necessarily be available on any one vehicle.

Did You Know?

Gujarat has the swiftest scheme on road to approve fleet e-vehicle conversions, with settlement claims under 30 days by 2025.

What are the Indian State policies on the resale, service and insurance costs of your EV in 2025?

You may be an EV user and ask yourself what other factors beyond initial cost might be lurking in the corners. What policy environment entails to you:

Resale Value:

- States with more established, deep-pocketed policies experience greater buyer assurance and resale demand; buyers do not fear charging or parking.

- The states with high second-hand EV resale value (25-30 percent higher as per OLX Auto Jan 2025 report) include Delhi/NCR, Maharashtra, and Gujarat, mainly because of the high density of public chargers and the awareness of policies.

After Sales Service

- High EV states will prompt manufacturers to establish additional service points-Tata, MG & Mahindra increased their service points in 2023-25.

- These states are better in terms of quick servicing and availability of spares.

Insurance Premiums:

- In various cities (Delhi, Bangalore, Mumbai), EV insurance has become 1015 percent cheaper than ICE cars because of integrated state safety standards and lower yearly claim rates (IRDA 2025).

Battery Warranty And Swap

- States that allow battery swapping/reporting (Tamil Nadu, Delhi) will enable battery as a service models to lower your long-term cost.

Laws #9682 Driving Assistance

- Clear state policies assist with priority road clearance, parking at public places and immediate government action on complaints.

Expert Insight

In Maharashtra and Delhi, lenders are now offering 0.25-0.5 percent lower interest on EV car/bike loans than ICE vehicles, because of state guarantees and loss-write downs.

Who is to Questioning Now to Act? Facts Ruled Permanent Judgement)

You are an Indian, a buyer or an entrepreneur, in the year 2025:

- Customers in the states where the policies are active and well-funded (Delhi, Maharashtra, Gujarat, Kerala) can now buy EVs to enjoy the current subsidies, low road tax, and future resale. The budget caps imply that early birds get the best price

- Business/fleet owners must focus on registration, operations and expansion in states where state/commercial permits and infrastructure is robust (Telangana, Kerala, Maharashtra, Delhi).

- New start-ups and plants would be interested to locate in Tamil Nadu, Karnataka, and Telangana, which continue to have abundant land, capital, power, and GST concessions.

- In the slower states, users must monitor policy changes in late-2025 or use the all-India FAME scheme and pressure new local incentives.

Note: Your best option will always be based on the changing state policy and budget capping as well as infrastructure projects. Bookmark your state government EV policy page or EV India discussion boards to be on top.

Additional FAQs (2025) State Wise EV Policy Summaries

Q1. Can I buy an EV in one state and resister it in another and still get all subscriptions?

No, you only receive state EV incentives on the state where you purchase and register the vehicle. Central FAME scheme is country-wide, but state subsidies are forfeited upon interstate transfer.

Q2. Is there a subsidy on second-hand EVs in 2025?

No, since as of 2025 only new first-owner vehicles bought and registered in official channels will be eligible to receive EV subsidies by the state.

Q3. Are battery replacement subsidies offered by states?

Not many direct subsidies- most policies (Delhi, Kerala) are around swapping infra, not replacement grants, etc.

Q4. Are central and state incentives poolable on the same fleet?

Not always, sometimes. Depending on the states, some allow you to pool the central incentive, others subtract it in state pay-out. Always see official notification regarding 2025 details.

Q5. Where will I access the updated eligible models list on state EV subsidies in 2025?

There is a list published by each state on their transport or EV portal and you need to ensure that your vehicle (make/model/variant) is approved to receive subsidy.

The most intelligent thing you can do as an individual is exploring Indian EV policies state-wise so that you can make a realistic and smart decision regarding your next EV, investment, or business. With feasible facts and experience of real users in 2025, you will become electrically ready to move!

Exploring Indian EV policies state-wise is the best way for you to make a smart, realistic choice for your next EV, investment, or business. With practical 2025 facts and real user experiences, you will be ready to move electric with confidence!