Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Summarize & analyze this article with

Choose an AI assistant and open this article directly:

Tip: if the AI doesn’t fetch the page automatically, paste the article URL manually.

What is the Production-Linked Incentive (PLI) Scheme for the Electric Vehicle Sector in India (2025)?

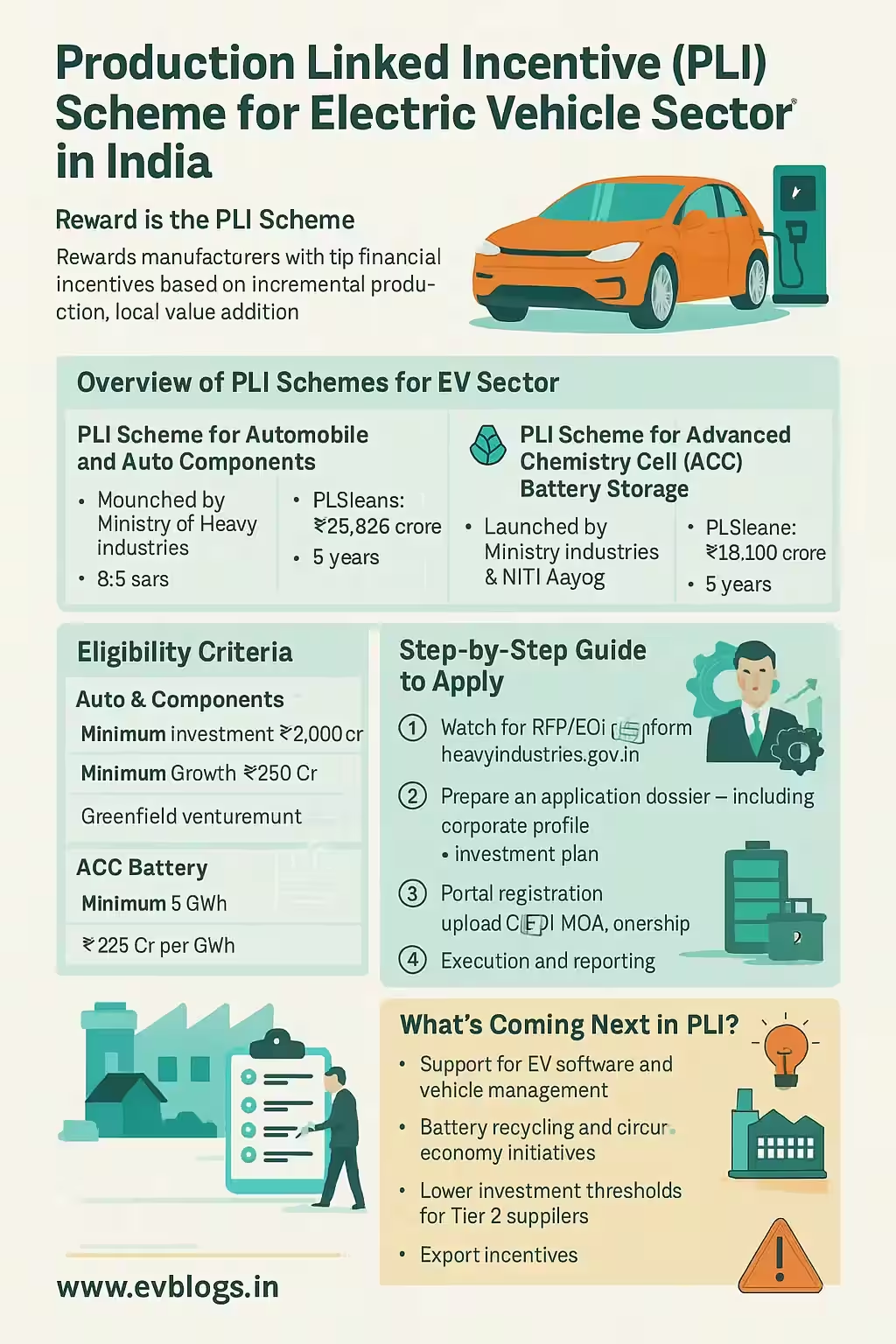

India’s Production-Linked Incentive (PLI) Scheme for the electric vehicle (EV) sector is a government initiative that encourages local manufacturing of electric vehicles and their components. By 2025, this scheme has become a central part of India’s strategy to reduce its oil imports, cut down pollution, and position itself as a global EV manufacturing hub.

- The PLI Scheme for the automotive sector, including EVs, was launched in 2021 but has been updated to adapt to the market needs for 2025.

- It offers direct financial incentives to eligible manufacturers based on their incremental sales of EVs and high-value components manufactured in India.

- The scheme is operated by the Ministry of Heavy Industries (MHI) and has a total outlay of ₹25,938 crore for the auto sector, of which a significant portion targets the EV ecosystem.

- As of 2025, the scheme is valid up to 2027, with applications invited annually for new as well as expansion projects.

Key Facts:

- Incentive ranges: 8% to 18% of incremental sales value.

- Eligible vehicles: Electric 2-wheelers, 3-wheelers, passenger cars, commercial vehicles, and buses.

- Component coverage: Batteries, motors, controllers, power electronics, and advanced automotive technology.

Did You Know? According to the Ministry of Heavy Industries, PLI beneficiaries contributed to a 250% surge in EV sales in India between 2022 and 2024.

Why Should You Consider Applying for the PLI Scheme for EVs in 2025?

If you are planning to manufacture electric vehicles or their components in India, the PLI scheme can give you a strategic edge—financially, operationally, and competitively. Here’s why it’s important:

- Financial Boost: Get up to 18% direct incentive on sales, helping reduce your operational costs and increase profitability.

- Global Competitiveness: Gain access to global supply chains by meeting international quality standards required by the scheme.

- Government Backing: The PLI scheme assures stable, long-term government support, minimizing policy risks for your investments.

- Sustainable Growth: Align your business with India’s sustainability goals and future-ready mobility sector.

- Innovation Push: Incentivizes R&D investments for next-gen EV technologies.

Benefits You Get from the PLI Scheme

- Direct cash incentives for increasing production and sales.

- Priority access to related government programs and tenders.

- Enhanced brand reputation as a government-backed manufacturer.

- Opportunity to collaborate with global EV supply chains.

Expert Insight “Manufacturers covered under PLI see faster access to export markets, given the emphasis on quality and advanced technology,” says Dr. Rajiv Sharma, auto industry analyst (2025).

Who is Eligible to Apply for the PLI Scheme for the Electric Vehicle Sector in India?

Knowing if you qualify is the first step. The government has set clear criteria to ensure genuine manufacturers benefit.

You are eligible if you:

- Are registered in India as a company or LLP.

- Propose to manufacture eligible EVs or their Advanced Automotive Technology (AAT) components in India.

- Meet minimum investment thresholds:

- ₹2,000 crore for complete EV manufacturing (as of 2025).

- ₹250 crore for advanced EV components.

- Have a clear business plan demonstrating incremental sales and job creation.

- Have not been blacklisted or penalized by any government agency.

- Commit to local value addition (with phased manufacturing roadmaps).

Main Categories Eligible Under PLI

- OEMs (Original Equipment Manufacturers) making electric 2W, 3W, cars, buses, trucks.

- Component manufacturers: battery cells, motors, inverters, onboard chargers, etc.

- New players setting up greenfield operations.

Checkpoints Before You Apply

- Are your products listed in the government’s eligible list?

- Is your investment committed for at least five years?

- Do you have annual audited financial statements (for existing players)?

Did You Know? In 2025, over 95 companies have qualified under PLI, out of which 30% are new entrants focusing on EVs.

When is the Right Time to Apply for the PLI Scheme for EV Manufacturing in India?

Application windows for the PLI scheme are strictly defined. Missing deadlines could mean losing out on incentives for the fiscal year.

Current Application Timeline (2025)

- Application window for FY 2025-26: January 15, 2025 – March 31, 2025.

- Results/approvals: By May 2025.

- Incentives disbursed: Annually, post-audit of performance.

Key Things to Remember

- Early submission increases your chances of receiving approvals faster.

- Ensure all documents (project report, investment proof, audited accounts) are ready before starting the process.

- Applications submitted after March 31, 2025, will not be considered for the 2025 cycle.

Annual Cycle

- Government opens application windows once a year.

- Approvals are granted in batches to manage evaluation and disbursement efficiently.

Expert Insight “Applying early in the window allows for corrections if the government raises queries. Last-minute applications are often delayed or rejected,” notes Deepika S., PLI consultant (2025).

How Do You Apply for the PLI Scheme for EVs in India in 2025?

Applying to the PLI scheme can appear complex, but following a step-by-step approach makes it much easier. Here’s a breakdown:

Step-by-Step Application Process

Register on the Auto PLI Portal

- Visit the MHI PLI Portal.

- Create an account using your corporate credentials.

Prepare Your Documents

- Incorporation certificate, PAN, GST registration.

- Detailed project report (DPR) with investment, sales, and employment projections.

- Board resolutions and MoUs with vendors/partners.

- Audited financial statements (last 3 years for existing firms).

Submit the Online Application

- Fill out the online form with company, project, and product details.

- Upload required documents in prescribed format.

Pay the Application Fee

- Fee varies depending on investment size (ranges between ₹50,000 to ₹2 lakh).

Respond to Evaluation Queries

- Government may seek clarifications. Respond promptly.

Approval and Agreement Signing

- If approved, sign a PLI agreement with the Ministry of Heavy Industries.

Start Reporting

- Submit quarterly/annual reports on sales, investments, and job creation for incentive disbursement.

Documents Checklist

- Company registration documents

- Project report

- Investment plan

- Land ownership/lease papers (if new plant)

- Financial statements

- Vendor contracts

Did You Know? As of March 2025, the average approval time for error-free applications is just 45 days.

Which Categories of Electric Vehicles and Components are Covered Under the PLI Scheme (2025)?

The PLI scheme is comprehensive and covers nearly the full EV value chain. It’s important to know whether your product falls within the eligible scope.

Eligible Product Categories

Complete Electric Vehicles:

- Two-wheelers (scooters, motorcycles)

- Three-wheelers (rickshaws, cargo)

- Four-wheelers (cars, SUVs, vans)

- Commercial vehicles (buses, trucks, LCVs)

Advanced Components:

- Lithium-ion battery cells and packs

- Drive motors, inverters, controllers

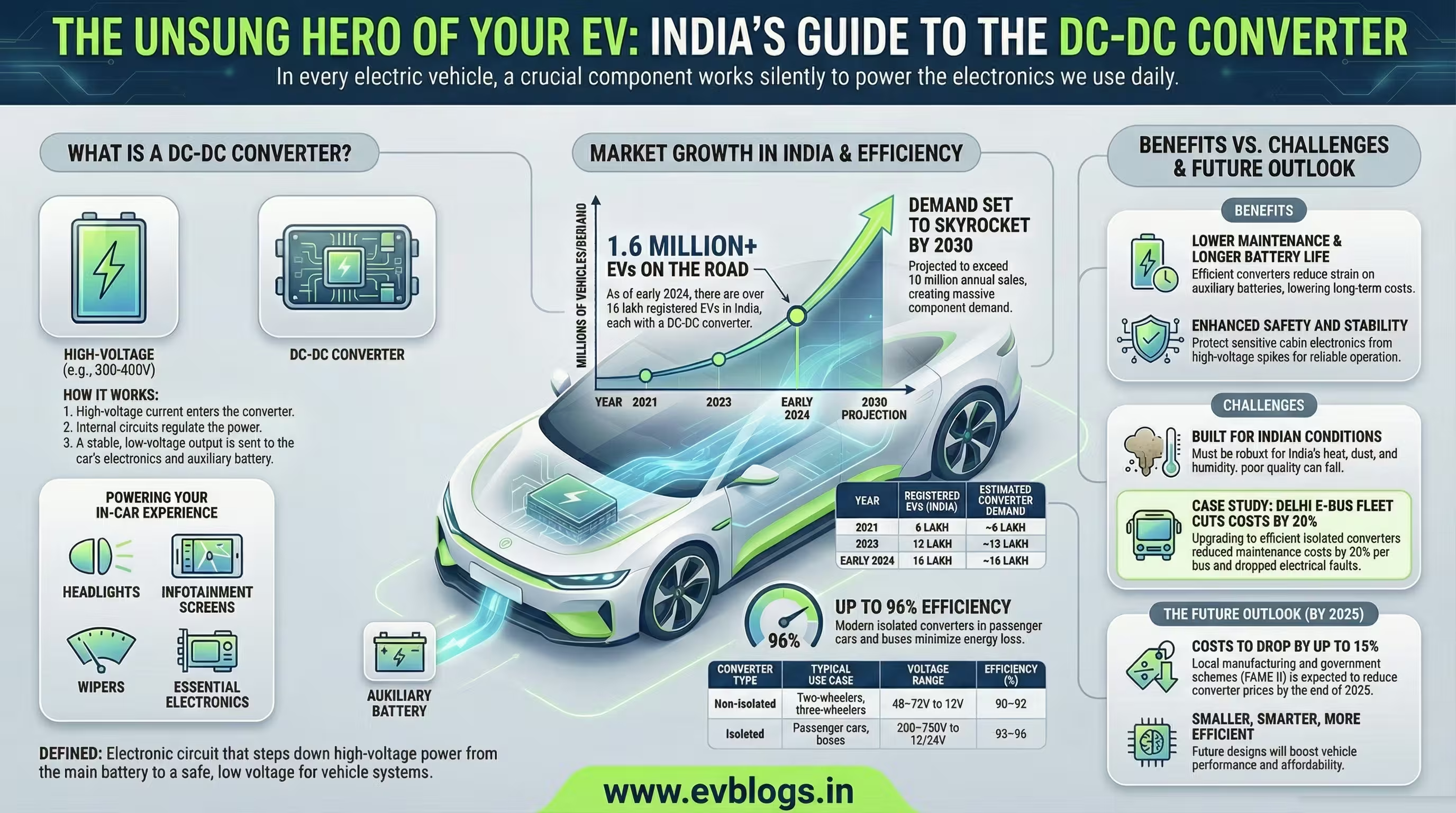

- On-board chargers, DC-DC converters

- Thermal management systems

- Telematics, advanced driver assistance systems (ADAS)

- Lightweighting materials and EV platforms

Special Focus Areas

- Components contributing to higher value addition and technology leadership are prioritized.

- Greenfield and brownfield projects both eligible, but must meet localization norms.

Not Covered

- Retrofitting kits for ICE vehicles.

- Low-tech parts not contributing to technology advancement.

Expert Insight “PLI’s focus on advanced tech makes it globally competitive, especially for battery and powertrain manufacturers,” highlights NITI Aayog’s Mobility Report (2025).

How Does the PLI Scheme Compare to Other Incentives for the Indian EV Sector?

Before applying, it’s smart to know how PLI stacks up against other government support programs. Here’s a comparison of the major schemes available as of 2025:

| Scheme Name | Target Beneficiaries | Nature of Incentive | Total Outlay (₹ Cr) | Incentive Rate | Duration | Focus Area |

|---|---|---|---|---|---|---|

| PLI Auto (EV) | OEMs, component manufacturers | Sales-linked cash incentive | 25,938 | 8-18% | 5 years | Advanced EVs, high-tech components |

| FAME II | OEMs, buyers | Upfront subsidy | 10,000 | Varies by vehicle | Till 2027 | EV buyers (pass-through to OEMs) |

| ACC Battery PLI | Battery manufacturers | Output-based cash incentive | 18,100 | Up to 20% | 5 years | Advanced chemistry cell manufacture |

| State EV Policies | OEMs, buyers, infra developers | Stamp duty, CAPEX subsidy | Varies (State-wise) | 10-25% (CAPEX) | 3-7 years | Land, infra, GST breaks, demand creation |

| Start-up Incubation Grants | Start-ups, innovators | Grants, soft loans | 500+ | 80% project cost | Varies | Product development, prototyping |

Description of the Main Schemes

- PLI Auto (EV): Best for established and new manufacturers aiming for large-scale production and export orientation.

- FAME II: Targets OEMs and buyers; good for those looking to boost domestic sales through demand-side incentives.

- ACC Battery PLI: Essential for those planning battery giga factories.

- State EV Policies: Ideal for start-ups and SMEs needing land/infra support.

- Incubation Grants: Suitable for innovators or R&D-focused enterprises.

Points to Consider

- PLI offers the highest direct incentives for manufacturing.

- Most schemes can be combined (e.g., PLI + State incentives), subject to cumulative cap.

- FAME II is more “buyer-facing,” while PLI is “manufacturer-facing.”

Did You Know? Many Indian states (like Tamil Nadu, Maharashtra, Uttar Pradesh) offer 100% stamp duty waivers and capital subsidies for PLI beneficiaries.

What are the Key Documents and Compliance Requirements for PLI Scheme Application?

Getting your paperwork right is the single biggest factor in speeding up your PLI approval. Here’s what you need:

Essential Documents Checklist

- Certificate of Incorporation and Memorandum of Association (MoA).

- GST and PAN card copies.

- Investment plan with detailed financial projections.

- Land ownership/lease agreement (for plant location).

- Audited balance sheets (last 3 years, if applicable).

- Project report with technology details and Make-in-India compliance.

- Employment generation plan.

- Board resolution authorizing PLI application.

Ongoing Compliance After Application

- Timely submission of sales and production data (every quarter).

- Annual audit by statutory auditors and third-party certification (if required).

- Proof of incremental investment (bank statements, invoices).

- Environmental and safety compliance certifications.

- Local value addition reports (to meet phased manufacturing targets).

Pro Tips

- All documents should be digitally signed.

- Keep scanned copies ready in government-specified formats (PDF, under 5 MB per file).

Expert Insight “80% of delayed applications are due to incomplete or mismatched documents. Double-check the checklist before submitting,” says Shashank Mehta, EV industry consultant (2025).

How Much Incentive Can You Really Get Under the PLI Scheme for EVs in 2025?

Understanding the financial impact is crucial for your business planning. The scheme rewards you based on “incremental” sales and investments.

Incentive Calculation

- Base Incentive Rate: 8%–13% for EVs, up to 18% for advanced components (as per 2025 guidelines).

- Incremental Sales: Incentive applies only on sales above your “base year” (FY 2019-20 or first year of operation).

- Cumulative Cap: Each company is assigned a maximum eligible incentive (up to ₹6,000 crore for biggest OEMs).

Example Calculations

- If you sell ₹100 crore more EVs compared to the base year:

- You get 8–13% (i.e., ₹8 to ₹13 crore) as incentive, directly credited to your account after verification.

Incentive Slabs

- 8% for basic EVs (2W/3W).

- 10% for electric cars and LCVs.

- 13% for commercial EVs (buses, trucks).

- Up to 18% for high-tech components (battery cell, power electronics).

Key Rules

- No incentive for imported vehicles/components.

- Maximum eligibility period: 5 years from approval.

- Must maintain committed investments and employment.

Sample Incentive Table for Quick Reference

| Type of EV/Component | Base Incentive Rate | Max Incentive per Year | Conditions |

|---|---|---|---|

| Electric 2W/3W | 8% | ₹100 crore | Min. ₹500 crore investment |

| Electric Cars/LCVs | 10% | ₹500 crore | Min. ₹2,000 crore investment |

| Electric Buses/Trucks | 13% | ₹1,000 crore | Min. ₹3,000 crore investment |

| Battery/Pwr Electronics | 15–18% | ₹1,200 crore | Advanced tech, localization needed |

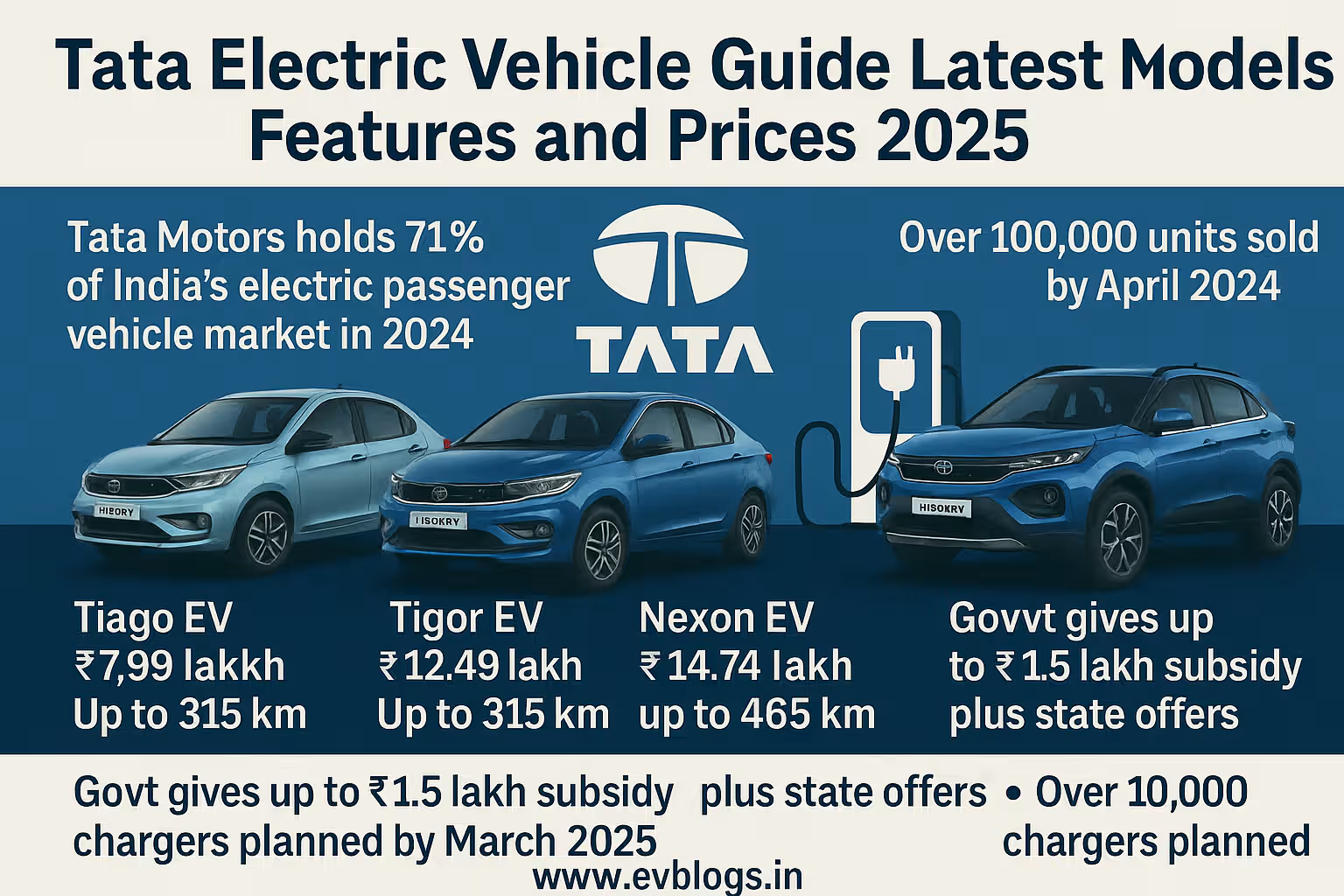

Did You Know? Leading OEMs like Tata Motors and Mahindra Electric have already received over ₹300 crore each under PLI as of early 2025.

Which Are the Top Companies Benefiting from the PLI Scheme in the Indian EV Sector (2025)?

Knowing who’s already succeeded gives you a benchmark. Here are the top 10 companies and their achievements with PLI:

| Company Name | PLI Eligibility | Focus Segment | Notable Achievement (2025) | Estimated Incentive (2025, ₹ Cr) |

|---|---|---|---|---|

| Tata Motors | OEM | Cars, buses, LCVs | Launched India’s 1st mass-market EV SUV export | 310 |

| Mahindra Electric | OEM | Cars, 3W, SUVs | New EV plant in Pune operational | 285 |

| Ola Electric | OEM | 2W, batteries | EV scooter exports to Europe | 210 |

| Hyundai Motor India | OEM | Cars | Local cell manufacturing started | 180 |

| TVS Motor Company | OEM | 2W, 3W, batteries | Doubled EV 2W production capacity | 135 |

| Exide Industries | Components | Batteries | New 5 GWh battery plant, JV with OEMs | 125 |

| Ather Energy | OEM | 2W, batteries | Record domestic sales, new plant in TN | 110 |

| Hero Electric | OEM | 2W | Expanded to 500+ dealerships | 90 |

| Bosch India | Components | Motors, electronics | Exported drive motors to Europe, US | 80 |

| Amara Raja Batteries | Components | Batteries | Gigafactory for LFP cells launched | 75 |

What Sets These Companies Apart

- Early adoption and aggressive investment in new technologies.

- Localized supply chains to meet Make in India targets.

- Strong R&D and quality focus (meeting global norms).

- Partnerships with global majors (for technology transfer).

Trends from Case Studies

- Tata Motors: Leveraged PLI for rapid EV scale-up and exports.

- Ather Energy: Used incentives to set up new assembly lines and battery facilities.

- Ola Electric: Focused on vertical integration, from battery to last-mile delivery.

Expert Insight “PLI winners combine deep localization, export focus, and robust R&D capabilities,” says Mr. Ajay Goenka, FICCI Auto Council Chair (2025).

How to Get the Most Out of the PLI Scheme? Tips, Common Mistakes, and Success Stories

To maximize your PLI benefits, learn from the experiences of others—what works, what doesn’t, and how to avoid pitfalls.

Tips for Success

- Start Early: Begin documentation and project planning at least 3–4 months before the window opens.

- Align with State Policies: Combine PLI with state incentives for higher net benefits.

- Invest in R&D: Prioritize advanced tech components, as they attract higher incentives.

- Strong Partnerships: Form alliances with vendors for localization and technology transfer.

- Regular Compliance: Stay proactive about quarterly and annual reporting to avoid disqualification.

Common Mistakes to Avoid

- Submitting incomplete applications or outdated financials.

- Overstating sales or investment projections (can lead to penalties).

- Missing the annual reporting deadlines.

- Relying solely on imports (no incentive on imported content).

Real User Stories

- SMEV Tech Pvt Ltd: “We almost missed out due to a missing GST certificate. Getting help from a compliance consultant saved our application.”

- GreenVolt Motors: “By starting our plant construction before approval, we could show quick progress and received incentives in the first year itself.”

- PowerDrive Components: “Collaborating with an international battery OEM helped us meet advanced tech localization norms and increase our incentive rate.”

Did You Know? In 2025, over 90% of approved PLI projects used local vendor partnerships to meet value addition requirements.

What Challenges Might You Face, and How Can You Overcome Them When Applying for the EV PLI Scheme?

While the PLI scheme offers big rewards, there are definite hurdles. Knowing these challenges can prepare you for a smoother journey.

Main Challenges in 2025

- Stringent Eligibility: High investment thresholds can be tough for MSMEs.

- Complex Documentation: Multiple approvals and audits needed.

- Localization Targets: Sourcing advanced tech locally can be difficult.

- Timely Reporting: Missing compliance deadlines could lead to forfeiture of incentives.

- Cash Flow Gap: Incentive is post-facto—requires upfront investment.

Solutions and Workarounds

- Consortium Approach: MSMEs can form clusters to meet investment norms.

- Hire Professional Advisors: Compliance consultants can handle paperwork and audits.

- Leverage MoUs: Collaborate with global technology providers for localization.

- Track Deadlines: Set up internal teams for compliance and reporting.

- Use Other Schemes: Combine with FAME-II and state subsidies to manage cash flows.

Case Study

- Bolt EV Components (Bengaluru): Faced initial rejection due to lack of land documents. They later partnered with an industrial park to provide the necessary compliance, and their project was approved in the next cycle.

Expert Insight “Successful applicants treat compliance as an ongoing process, not a one-time event,” notes Priya Chandran, PLI legal advisor (2025).

How Will the PLI Scheme Impact the Indian Electric Vehicle Market by 2025 and Beyond?

The PLI scheme is already reshaping the Indian EV landscape—and its effects will deepen by 2025.

Major Impacts

- Growth in Domestic Manufacturing: India is expected to reach 30% EV penetration in new vehicle sales by 2026, up from just 1% in 2020.

- Job Creation: PLI-backed projects are projected to generate over 2 lakh (200,000) new jobs by end-2025.

- Export Hub: India now exports electric scooters, cars, and batteries to over 25 countries, a direct outcome of PLI incentives.

- Technology Upgradation: Focus on Make in India and advanced tech has improved product quality and reduced costs.

- EV Adoption: Increased manufacturing is bringing down vehicle prices, making EVs accessible to more Indians.

Market Outlook

- By 2025, India’s EV market size is projected to exceed $15 billion.

- Battery manufacturing capacity is set to cross 50 GWh by late 2025.

- Domestic content in EVs has risen from 30% in 2021 to 70% in 2025.

User Perspective

If you’re a manufacturer or SME, the PLI scheme can future-proof your business, provide global competitiveness, and support your growth story.

Did You Know? India’s EV sector saw a record investment of ₹40,000 crore between 2021 and 2025, largely driven by PLI and allied state incentives.

Conclusion: Should You Apply for the PLI Scheme for EVs in India in 2025?

The Production-Linked Incentive (PLI) scheme for electric vehicles and advanced components in India is not just another subsidy—it’s a transformative policy aimed at turning India into a global EV powerhouse by 2025 and beyond. If you’re serious about manufacturing EVs or their components, this scheme is your ticket to:

- Substantial financial incentives for scaling up.

- Strong government support and market credibility.

- Access to both domestic and export markets.

- Opportunities to innovate and lead in next-generation mobility.

However, success demands meticulous planning, timely documentation, and a focus on technology localization.

Final Verdict:

If you have the vision, investment, and compliance discipline, applying for the PLI scheme in 2025 is one of the smartest moves you can make in the Indian EV industry.

Frequently Asked Questions (FAQs)

Q1. Can start-ups apply for the PLI scheme for EVs in India in 2025?

Yes, start-ups can apply if they meet the minimum investment and localization requirements specified by the government.

Q2. Can you combine PLI incentives with state government EV subsidies?

Absolutely. Most states allow PLI beneficiaries to also claim state capital subsidies, stamp duty waivers, and power tariff concessions, subject to cumulative incentive caps.

Q3. Is there any penalty for failing to meet investment or sales commitments under PLI?

Yes, companies that underperform may have their incentives clawed back and could be debarred from future applications.

Q4. Do imported EVs or components qualify for the PLI scheme?

No. Only goods manufactured in India, meeting the prescribed localization norms, are eligible.

Q5. How long does it take to receive the incentive payout after applying?

Typically, it takes 60–90 days post-approval and successful reporting/audit of incremental sales and investment data.

Disclaimer: This article is for informational purposes only. For the latest policy updates, consult the official Ministry of Heavy Industries portal or seek advice from a professional consultant. All data and statistics are based on government reports and industry sources as of 2025.